Reasons to own gold. Gold in dollar terms, hit a major spot price milestone of over $2000 an Ounce back in August 2020, which was the highest price it has ever been. There have been recent pull backs, however, this is a key indicator that there is more and more interest in the precious metals market.

This might lead many investors to think, is now a good time to invest in gold or am I too late to the party?

Table of Contents

6 Reasons to own gold.

For centuries, gold has always been perceived as the ultimate safe haven asset and an excellent store of value. Gold has no counterparty risk and has managed to preserve its purchasing power through history. Gold is inherently scarce and is often perceived as the purest form of money.

Will the price of gold continue to go up?

No one can predict the future, however, let’s go through some reasons why many gold bugs are still bullish on gold.

Money supply is expanding.

Fiat currencies can basically be created out of thin air, therefore, governments and central banks can’t help themselves and always resort to printing more money (fiat currency), especially in times of crisis. If you look back through history, then inevitably the value of fiat currency declines, therefore, the price of gold denominated in fiat currency usually goes up.

“According to a study of 775 fiat currencies by DollarDaze.org, there is no historical precedence for a fiat currency that has succeeded in holding its value.”

Therefore, until now, with the exception of some countries currencies converting to other fiat currencies such as the euro, every fiat currency in history has gone to its intrinsic value of zero.

In 1971, president Richard Nixon ended the U.S. dollar convertibility to gold, which essentially ended the Bretton Woods system (The Bretton Woods System required a currency peg to the U.S. dollar which was in turn pegged to the price of gold). This made all major currencies around the world enter into a full fiat currency system.

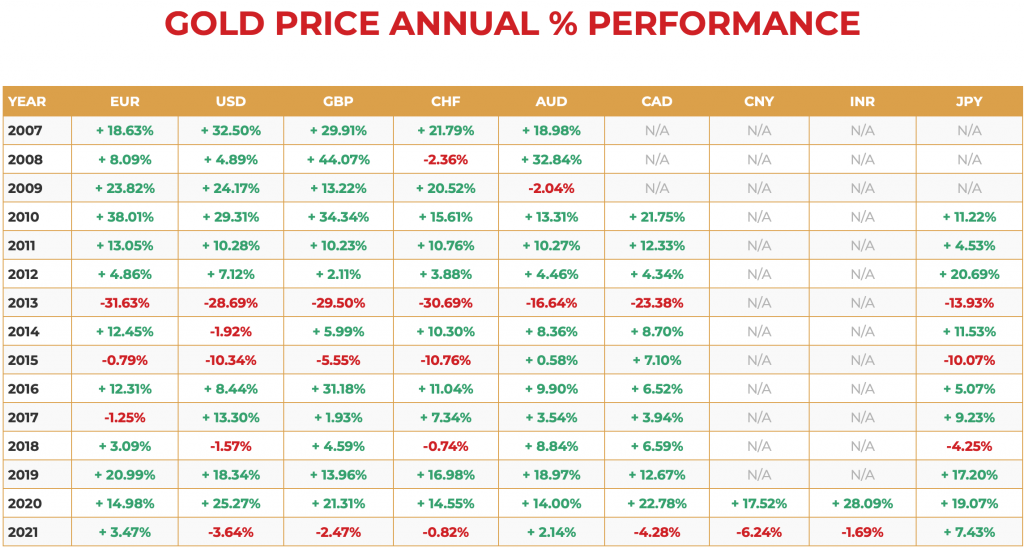

The gold price in 1971 was around $42 per ounce. The price of gold today is hovering around $1900 an ounce, an increase of way over 4000%! This is mainly down to the fact that the value of the dollar and all major currencies is going down. In fact, gold has increased in value compared to every major fiat currency, including the British pound.

QE (Quantitative Easing AKA printing money) was only supposed to be a temporary measure, however QE has never stopped. Since 2008 the Bank of England has undertaken a series of bond purchases which have built up over the years, starting with £200 billion in November 2009, increasing to a total of £375 billion in July 2012, then £435 billion in August 2016, moving up to £645 billion in March 2020, then £745 Billion in November 2020 with a total now £895 billion in November 2020. (source: bankofengland.co.uk). Due to the current situation QE is still occurring at pace.

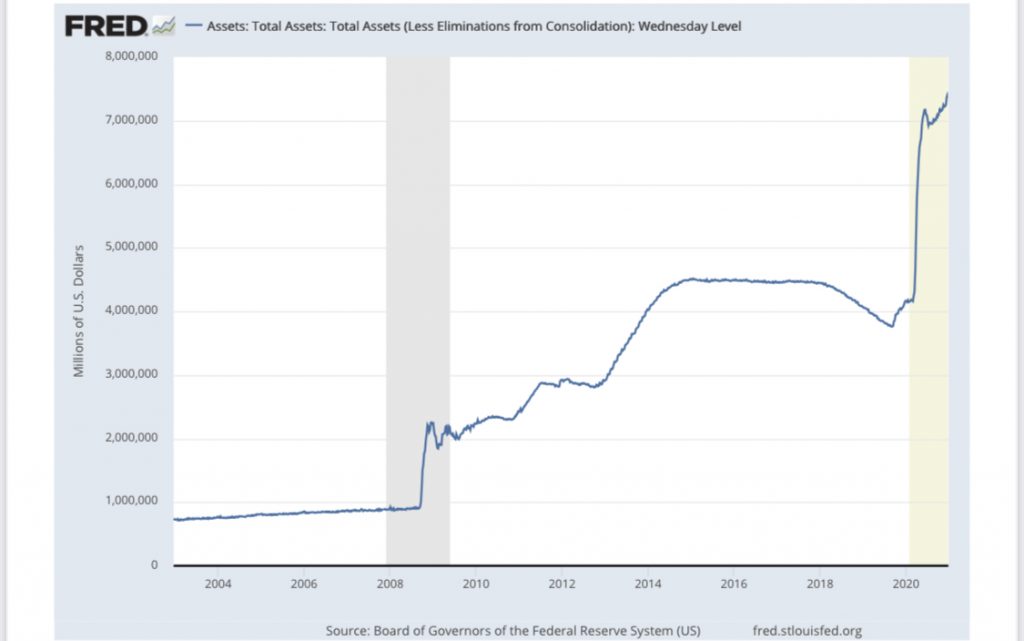

In November 2008 the FED (Federal reserve) started buying up financial assets totalling $600billion.

By March 2009 the FED held $1.75trillion and peaked at $2.1trillion. In November 2010, the FED announced another round of QE, buying $600billion of Treasury securities. QE3 (a third round of quantitative easing), was then introduced when the FED announced a new $40billion monthly open-ended bond purchasing programme. By December 2012, this was increased to 85billion per month. Purchases were halted in October 2014 by then accumulating $4.5trillion in assets, (source Wikipedia).

U.S. Congress recently approved a $900 billion stimulus package.

The Federal Reserve’s balance sheet has grown by about $3 trillion since mid-March 2020.

Ongoing QE programmes into 2022 are now pushing the FED balance sheet over $7trillion.

Obviously, there have been ups and downs in the price of gold along the way, however, gold has always eventually compensated the devaluing fiat currencies.

Over time, currencies inflate and devalue compared to gold at various rates, while gold usually holds its purchasing power over the long term.

BullionVault lets private investors around the world access the professional bullion markets. You can benefit from the lowest costs for buying, selling and storing gold and silver.

4 Grams of FREE Silver on Sign up! VISIT BullionVault

Low interest rates.

Currently The Bank of England has maintained low interest rates even as low as an incredible 0.1% which is the lowest rate it’s ever been in the Bank of England’s 325 year history.

The Bank of England was also looking into the possibility of introducing negative interest rates in 2021. (Read more about negative interest rates here).

Astonishingly, some countries such as Switzerland, Sweden and Japan amongst others, now have negative interest rates. This has never occurred before in history, so we are now in truly unchartered financial waters.

Having your savings in a bank is now costing you money, as there is still continuous price inflation, while bank interest rates are basically zero or even negative.

Bank of England base rate is still incredibly low in 2022.

Investors may look at the bond market. Bonds are traditionally used as another form of safe haven for wealth.

Due to falling bond yields this may no longer be a viable, because of these bonds having very little upside, while still having some degree of counterparty risk.

Gold can act as an insurance policy in times of volatility in the stock market.

Often, when stock markets crash, many investors start to flee to the safe haven of gold which, in turn, causes the price of gold to rise. Stocks and gold are very often negatively correlated.

For example, the S&P 500 has had some wild fluctuations recently, with many experts claiming that it is in part, being held up by the Federal Reserve (FED) stimulating asset prices by injecting all sorts of liquidity.

With high stock valuations at the present time, this could also be due to an explosion in popularity of online trading apps such as ‘robinhood’, offering ‘commission free investing’. There is growing evidence that vast amounts of money from ‘stimulus checks’, has essentially been ploughed into the equity markets through these trading apps. This is pushing stock prices even higher, while at the same time the real economy is having major financial difficulties.

One extreme example of this huge volatility is Hertz, who filed for bankruptcy protection in late May 2020. On announcement, its share price jumped from a 26th May 2020, low of $0.40 per share, to a 8th June 2020 price of $6.25 per share, over 1400% increase in a company that is essentially bankrupt! Investors are stretching their optimism if they expect Hertz to emerge without making their stock worthless. This is a clear signal of how distorted the equity market is at the moment.

The world’s stock exchanges now have a capitalization of $85 trillion USD. This is an incredible increase of 320% since 2009. Back then their value was $25 trillion (source: Liberated Stock Trader via spendmenot.com).

Many gold bugs believe that gold is actually undervalued, as there are these massive bubbles in equity markets, and central banks continue to print money, which supports these bubbles.

This is a very unsustainable situation. When these bubbles burst, then all signs point toward a rise in the price of gold.

Adding gold to an investment portfolio can lower overall volatility and improve investment performance.

Not many people actually own gold. Yet!

The majority of investors have the classic 60/40 stock/bond portfolio which doesn’t own physical gold. The vast majority of Pensions, savings plans and insurance company portfolios don’t own gold.

The desire or need to own gold for investment purposes has been overlooked by many investors.

Gold tends to do very well in later portions of recessions, with current trends showing similarities to 2009, when gold was rising but not yet overpriced. The aggressive stimulus by central banks to offset the financial collapse, while at the same time, major solvency problems were starting to kick in.

When you look back at the last financial crisis of 2008/2009, then the price of gold started to rise dramatically and peaked in late 2011, as investors rushed into gold to preserve their wealth as the equity and property market was causing huge amounts of uncertainty.

This has some similarities to the phase we’re in now. Gold is slowly climbing and isn’t even at all-time nominal highs.

Gold is not really mentioned much in the mainstream media as a viable asset class. However, with the new high price of gold, you are starting to see more articles and main stream media coverage about gold and its investment advantages.

Once the mainstream media such as the BBC and CNBC start to talk about gold, then that creates something of a frenzy from retail investors who become highly interested in buying gold and gold stocks, potentially pushing the price of gold even higher.

Bank Bail-ins.

Bank bail-ins is becoming more of a threat during these times as the financial pressures on banks are huge. There is potentially a real risk of some banks becoming insolvent.

What is a bank bail-in? The European Union introduced the Bank Recovery and Resolution Directive in 2014.

When a bank becomes insolvent, the banks’ creditors and shareholders would pay the costs through a bail-in type mechanism. When you put your money into a bank it is technically no longer your money, that money is now owned by the bank, you are essentially an unsecured creditor of the bank.

Your deposits would essentially be seized to save the bank in the case of a bank becoming insolvent. Having large amounts of money (fiat currency) in a bank account could potentially be a real risk that not many people are actually aware of.

The Bond Bubble.

There is growing evidence to suggest that the sovereign bond market is in a bubble.

One clear sign of the sovereign bond market bubble is the fact that debt obligations of many developed nations now have a negative interest rate. This could suggest that these bonds are overvalued.

Recently the UK sold three-year government bonds with a negative 0.003% yield, this means that the government is being paid by investors to borrow from them!

Some of these investors buy bonds with negative yields because they believe future bonds will offer even worse returns.

All this investment in sovereign bonds is mainly due to central banks holding interest rates so low for so long, which has now caused huge distortion in the fixed income market.

Governments seem to be borrowing way beyond their means. World debt to GDP is currently over 330% (source).

Countries debt to GDP levels seem to be ever increasing, which is simply unsustainable. The only options to eventually reduce this debt is through inflation or restructuring of the debt. Either option is bullish for gold.

Gold.

Obviously there will be some natural corrections along the way, but there are many signals that are still bullish for gold.

There are many signs pointing towards huge bubbles in equity markets. At the same time, central banks continue to print vast amounts of money to support these bubbles. Over-investing in sovereign bonds has also caused distortions in the fixed income market, and negative-yielding debt has skyrocketed in recent years. Low interest rates have only exacerbated the issue, and economic growth around the world is continuing to collapse.

Common sense would be needed when buying gold for investment, which doesn’t mean buying gold at any price. When the price of gold goes up too far too fast, then obviously take a moment to re-evaluate.

Try not to get caught up in the frenzy, would this be a time to ease purchases and even sell some gold? On the other hand, if a sizeable correction came along, it might make some sense to accumulate more?

Gold is a strong, stable and simple investment for complex times.

BullionVault is the world’s largest online investment gold service taking care of $3 billion for more than 85,000 users.

4 Grams of FREE Silver on Sign up! VISIT BullionVault

Disclaimer: The articles or blog posts on this website are for general information/opinion purposes only and does not constitute either goldandsilveruk.co.uk or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the articles without first seeking independent professional advice. Care has been taken to ensure that the information in the articles are reliable; however, goldandsilveruk.co.uk does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such.

The site goldandsilveruk.co.uk will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in these articles or blog posts and any action taken as a result of the opinions and information contained in these articles or blog posts is at your own risk. All rights reserved www.goldandsilveruk.co.uk

This website/blog may generate revenue through paid sponsorships, advertising, paid insertions and affiliate partnerships.

goldandsilveruk is a precious metals enthusiast who wants to give authentic, clear, simple, transparent information and opinion to readers. Compensation may influence advertising content, topics or posts made on the blog. However, all paid and/or sponsored content and advertising space and posts would be identified.

All facts and claims made in posts should be independently verified with the manufacturer or provider. If a conflict of interest exists in the content, it may not always be identified.

Changes made to the policy will be identified on disclaimer page and in the general privacy policy and T&C.