UK chancellor Rishi Sunak has unwittingly created a wave of speculation over the UK state pension by implying that the ‘triple lock’ pledge could be scrapped or suspended due to rising concerns over inflation.

Table of Contents

The triple lock pledge.

The triple lock pledge guarantees that the basic state pension will rise by a minimum of either 2.5%, the rate of inflation or average earnings growth, whichever is largest.

Keeping it in place was a Conservative manifesto pledge, a promise that was meant to last until at least 2024.

In a recent interview with the BBC the chancellor Rishi Sunak said there were ‘legitimate concerns’ about the ‘fairness’ of the triple lock pension system. He added that a decision on pensions would be “based on fairness for pensioners and for taxpayers”.

On a BBC Radio 4 interview he goes on to say,

“The triple lock is government policy, but I recognise people’s concerns about what that might mean, given some of the numbers that are being put around.” (Source).

These comments by the chancellor seem to be coming from rising concerns over inflation and wage growth.

Inflation and wage growth.

As the UK economy begins to re-open again after the continued government imposed restrictions, this has caused a real surge in inflation and wage growth.

Under the current triple lock system the state pension is now gearing up to rise by 8% next year based on predictions by the Bank of England.

According to the Office for Budget Responsibility, the triple lock pension policy could potentially cost an already hugely indebted government an additional £3bn over the next year.

This has exposed the truths of the triple lock pledge, as due to inflation the cost of funding the state pension could spiral out of control.

The chancellor is under pressure.

The chancellor is under pressure to do something, and fast, before this situation puts even more strain on public finances.

Sunak told BBC Radio 4’s Today programme that there were, “some questions around the earnings numbers”.

Millions of UK citizens rely on the state pension due to many not having the opportunity to build up a suitable private pension or build sufficient investments for retirement.

Currently the triple lock is meant to ensure that your spending power will not diminish over the course of your retirement. However, if this scheme is scrapped, then there is a real risk that a different state pension scheme would simply not keep up with the rate of inflation and therefore, the overall cost of living.

The state pension should only really be seen as a supplement to private pension, savings.

Gold.

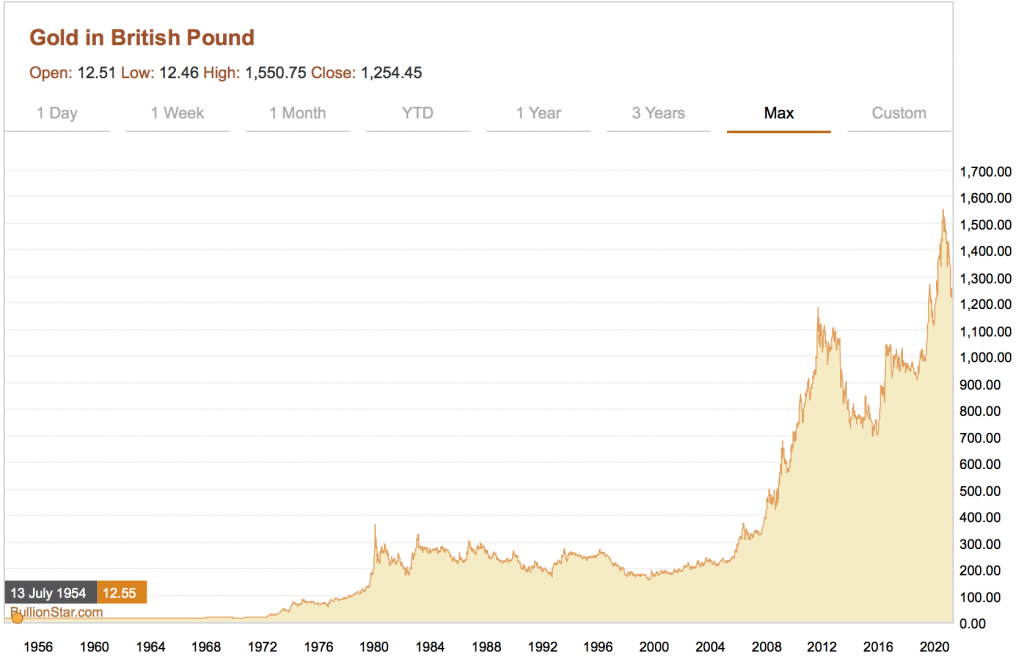

Historically, gold has been an excellent hedge against inflation.

Read more about UK Inflation here.

Main image by Paweł Szymczuk from Pixabay.