Table of Contents

The Global Gold Shift

In recent years, the gold market has experienced significant price appreciation, leaving many investors wondering what’s driving this momentum. While multiple factors contribute to gold’s rising value, one of the most compelling narratives can be found in the dramatic shift of gold production and accumulation from West to East – particularly China’s emergence as a gold powerhouse.

The Eastern Gold Renaissance

China has transformed into one of the world’s dominant gold producers, fundamentally altering the global precious metals landscape. According to the World Gold Council, China has been the world’s largest gold producer since 2007, mining approximately 370 metric tons annually in recent years – representing roughly 11% of global production. This represents a remarkable evolution from just a few decades ago when Western nations dominated the gold mining sector.

But China’s gold story extends far beyond production. The country has simultaneously emerged as one of the largest gold consumers, with Chinese citizens and its central bank accumulating vast quantities of the yellow metal. The People’s Bank of China has increased its official gold reserves substantially, reporting holdings of over 2,000 metric tons – though many analysts suspect the actual figure may be significantly higher.

This development isn’t isolated to China. Across Asia, countries like India, Russia, Turkey, and Kazakhstan have been aggressively expanding their gold reserves. The Reserve Bank of India now holds over 800 tons of gold, while Russia has more than tripled its gold reserves in the past decade to exceed 2,300 tons.

The 100-Year Cycle of Superpowers

This eastward shift of gold aligns remarkably well with historical patterns of rising and falling empires – what some economists refer to as the “100-year cycle of superpowers.” Throughout history, we’ve witnessed the rise and fall of dominant economic powers: from the Dutch in the 17th century to the British Empire in the 19th and early 20th centuries, followed by American economic dominance post-World War II.

Now, we appear to be witnessing another transition as Eastern economies – led by China – continue their economic ascent while many Western nations struggle with stagnating growth and mounting debt obligations. This shift in economic power correlates directly with gold accumulation patterns, as rising powers historically secure their position by building substantial gold reserves.

The Western Debt Spiral

Meanwhile, many Western nations find themselves trapped in what appears to be an unsustainable sovereign debt spiral. The United States’ national debt has surpassed $34 trillion, while the United Kingdom and much of Europe face similar fiscal challenges with debt-to-GDP ratios reaching concerning levels.

Canada presents a particularly striking case study. Despite being the world’s fifth-largest gold producer, Canada’s central bank holds effectively zero gold reserves, having sold off its holdings decades ago. This decision, once viewed through the lens of modern portfolio theory as prudent diversification, now looks increasingly problematic as inflation pressures mount and monetary reset discussions intensify.

Without significant gold reserves, countries like Canada may find themselves with diminished influence in any future monetary system reorganisation. As the old adage suggests, “Those who have the gold make the rules” – a principle that seems increasingly relevant in today’s volatile economic landscape.

Central Bank Gold Buying Reaches Historic Levels

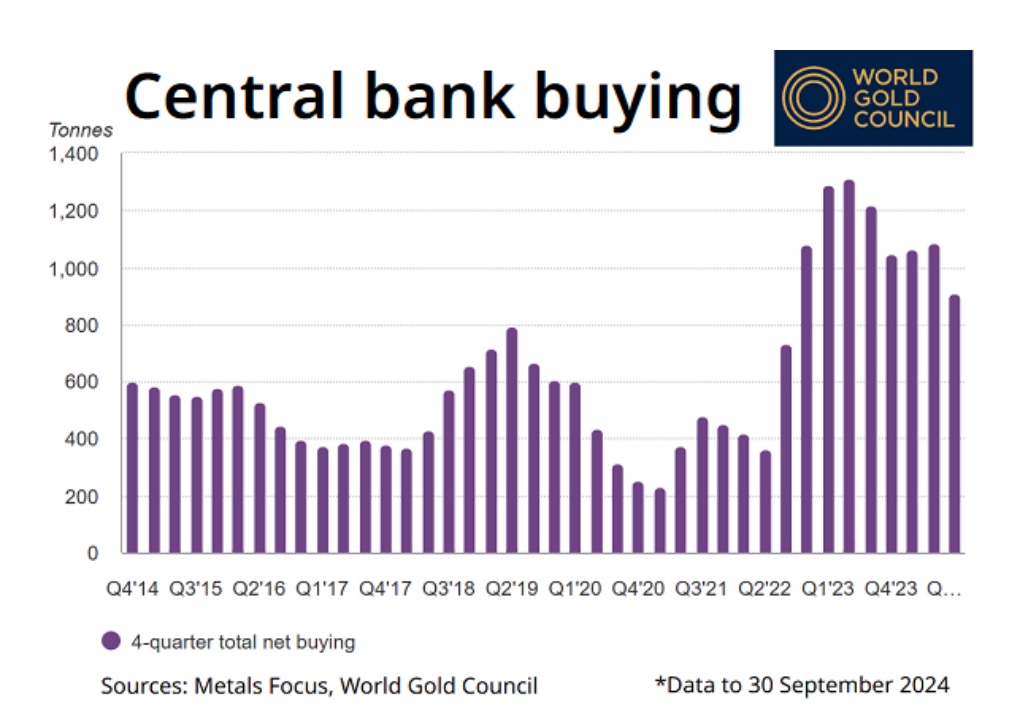

Beyond production figures, central bank gold purchasing provides even more compelling evidence of this East-West wealth transfer. According to the World Gold Council, central banks collectively purchased a record 1,136 tons of gold in 2022, followed by another 1,037 tons in 2023 – the highest levels of central bank gold buying in over half a century, the numbers keep rising for 2024/2025.

The composition of these purchases is telling. While Western central banks have largely paused gold accumulation (with some exceptions like Poland and Hungary), Eastern nations have been aggressive buyers. China, Turkey, India, and Russia have led this charge, collectively accounting for the majority of central bank gold purchases in recent years.

This trend represents more than simple portfolio diversification – it signals a strategic reorientation of the global monetary system. As these nations accumulate physical gold, they simultaneously reduce their exposure to Western currencies, particularly the US dollar, which has served as the world’s primary reserve currency since the Bretton Woods agreement.

The Implications for Investors

For precious metals investors, these developments carry profound implications. The structural shift of gold from West to East suggests sustained support for gold prices, as these emerging powers appear committed to long-term accumulation rather than short-term trading strategies.

Moreover, as inflation concerns persist across Western economies and debt levels continue their upward trajectory, gold’s traditional role as an inflation hedge and monetary alternative becomes increasingly attractive to investors worldwide.

The contrast between nations with substantial gold reserves and those without will likely become more pronounced in coming years. As monetary pressures build globally, countries with significant gold holdings may enjoy greater policy flexibility and financial sovereignty than their gold-poor counterparts.

The eastward migration of gold production

The eastward migration of gold production and reserves represents one of the most significant yet underreported economic developments of our time. It parallels broader shifts in global economic power and may foreshadow changes to the international monetary system that has prevailed since World War II.

For Western nations that have neglected their gold reserves, the consequences of this oversight may soon become apparent. As inflation pressures mount and debt sustainability questions intensify, those countries with substantial gold holdings will likely find themselves better positioned to weather financial storms and influence whatever monetary arrangements emerge from the current period of instability.

Gold is money, everything else is credit

The ancient wisdom that “gold is money, everything else is credit” may be reasserting itself in the modern era. As this financial reality becomes increasingly evident, the nations that have prepared accordingly by securing physical gold reserves stand to benefit most from the changing global order.

Note: This article represents the opinion of Gold and Silver UK and should not be considered financial advice. All investments carry risk, and readers should conduct their own research before making investment decisions.