Gold demand

Gold’s seasonal shape is a well-known fact to precious metal analysts, looking at gold demand through previous years.

The price of gold can sometimes rise in New Year and spring, followed by summer drop or lulls that are often connected with economic trends around the world; it has also been seen on numerous occasions over recent decades, where there is a further rise into the year-end almost every single time.

On such a basis, most precious metals analysts and traders tend to buy into, or out of, the spot gold market depending on what they think about the state of the world economy.

People that fear inflation or stagflation, tend to buy into gold bullion since they expect that both these factors will push the price of the yellow metal higher.

Those who think there is no inflation threat and are confident about economic growth, sell their gold mining shares in order to lock in profits after what has recently been a nice gain.

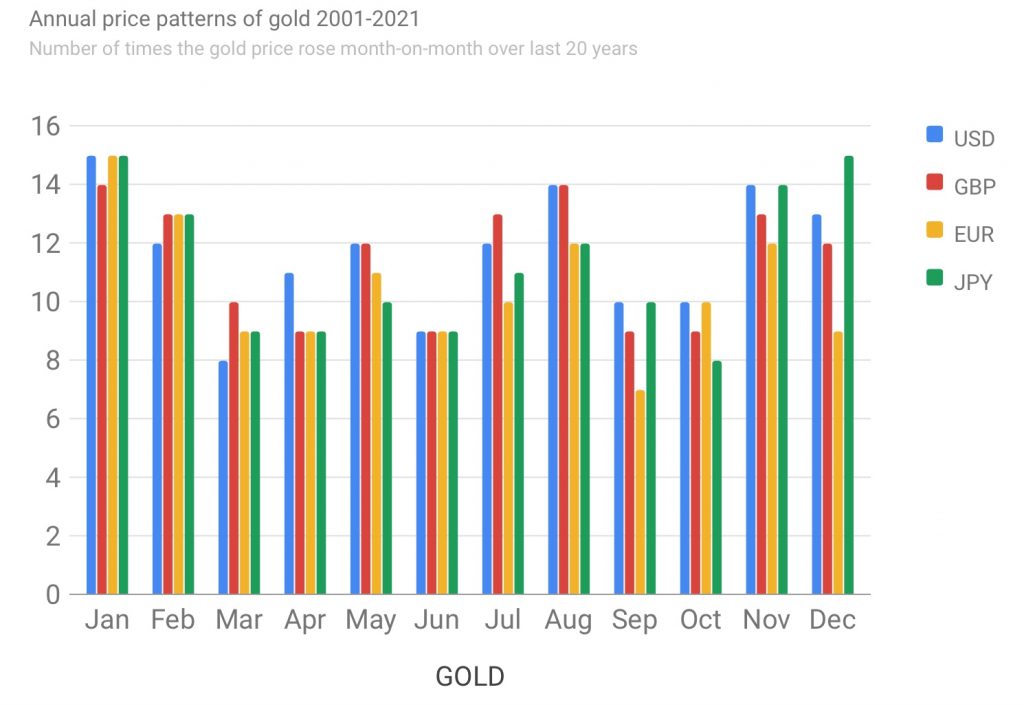

The following infographics show how gold prices have moved across the calendar year over recent decades.

The first chart (Annual price patterns of gold 2001-2021; Number of times the gold price rose month on month over the last 20 years) lets you count up all of those months where an increase was recorded in either US dollar terms, Euro or British pound sterling; while second infographic (Annual price patterns of gold 2001-2021: Average percentage change of the gold price month-on-month over the last 20 years) shows us what we at home would call, ”average monthly price change” for this precious metal.

Check out the charts below to see for yourself.

4 Grams of FREE Silver on Sign up! VISIT BullionVault

You can see that there is a certain pattern and it does seem as though there is a best time to buy into gold bullion or gold mining shares.

The January effect

The January effect is real!

As a result, the New Year plainly calls for significant investments in precious metals.

Gold has been on a streak of rising prices since 2001.

Silver seems to be following suit, with 14 successful increases in that time frame and 17 more during the last 20 years alone.

The start of this year has seen an increase in New Year interest.

Rebalance portfolio

One reason could be to review and rebalance portfolios.

Many investors use January as a time when they can assess their investments, looking at both risk factors coming up, such as the invasion into Ukraine, rising inflation and other economic threats.

Investors may look to new strategies on how best protect themselves from these potential difficulties, while also being aware that gold may be purchased because investors believe it’s worth investing into – especially since we’re heading towards the rest of 2022 without any certainties about what might happen next.

We all know that past performance is no guarantee of future success, but it’s pretty clear how investing in gold might be motivated.

It seems like December has always been a good time to buy these metals ahead of their prices, usually rising again in January.

4 Grams of FREE Silver on Sign up! VISIT BullionVault