The excessive money printing by central banks over the last year has now started to trickle through into the real economy, so is it simply time to get used to higher food prices, as well as higher prices on everyday goods and services in the UK?

In an recent interview with the Mirror, Ranjit Singh Boparan who is the owner of the UK’s biggest poultry supplier Bernard Matthews and 2 Sisters Food Group has stated that:

Inflation was “decaying the food sector’s supply chain” and that the government could not fix the problem.

The company is also facing soaring energy costs, which Boparan said had risen 450%-550% on last year.

“Food is too cheap,” he said, adding that the current price point for chicken for example is “unsustainable”.

Table of Contents

Higher UK food prices.

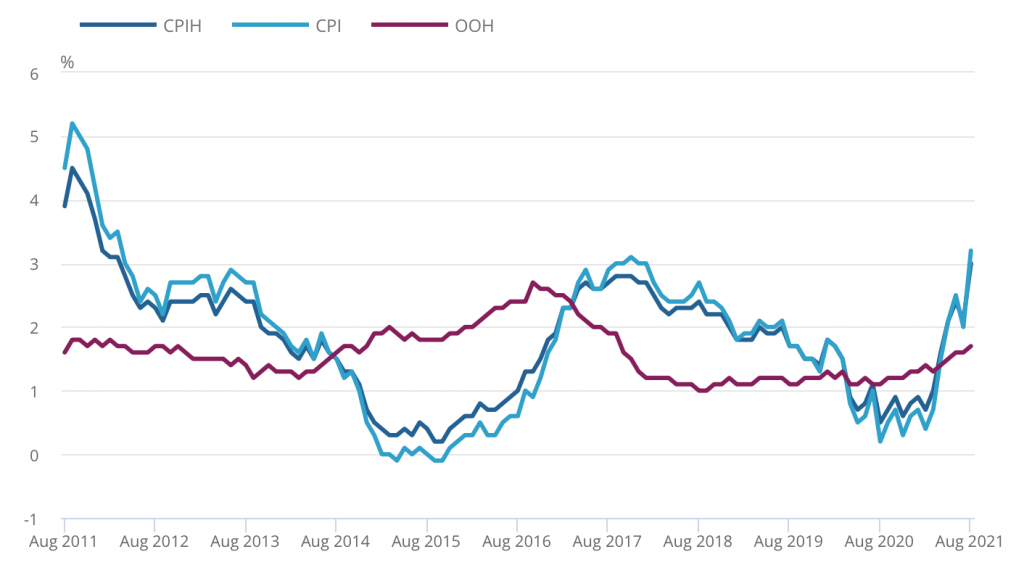

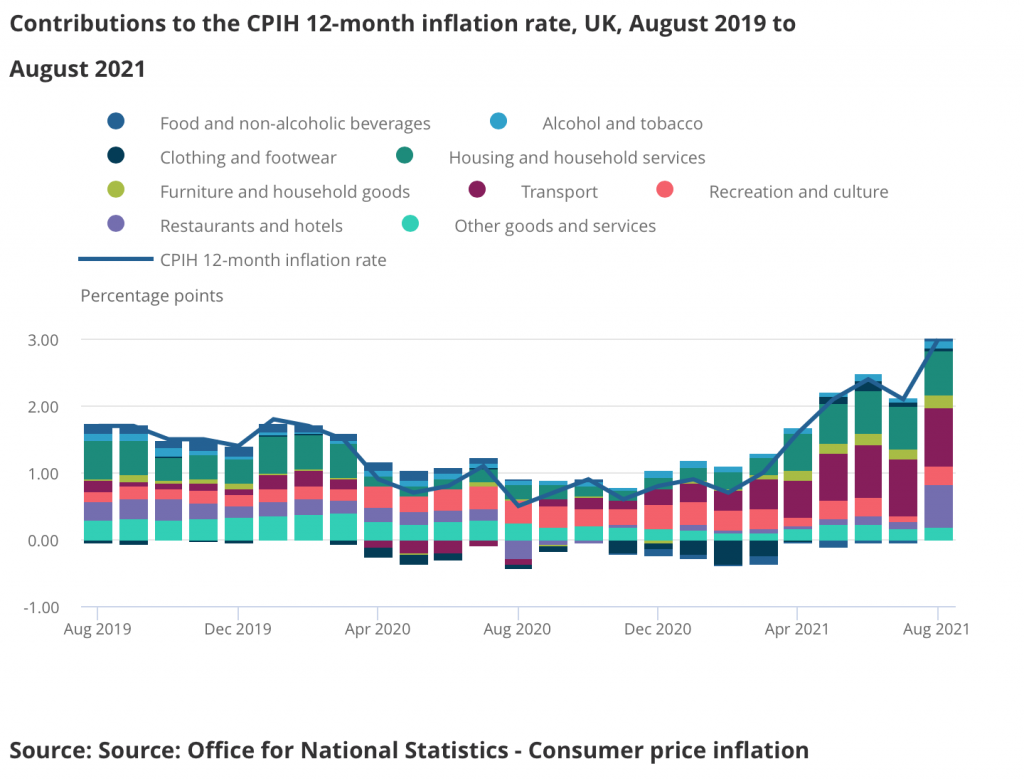

The Consumer Prices Index (CPI) rose by 3.2% in the 12 months to August 2021, up from 2.0% to July.

The increase of 1.2 percentage points is the largest ever recorded increase in the CPI National Statistic 12-month inflation rate series, which began in January 1997.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 3.0% in the 12 months to August 2021, up from 2.1% to July. This is the largest ever recorded change in the CPIH 12-month inflation rate.

Commodity and energy prices have played a role in the recent upward spiral in inflation, with the price of gas and oil surging as well as core commodities such as Copper way up in 2021.

Bank of England predicts that inflation will hit 4% this year.

The central bank’s monetary policy committee (MPC) has recently forecast inflation to hit 4% this year.

The BOE is consistently hinting that an increase in interest rates may be needed to fend off ever rising prices.

However, any interest rate rise could tip many borrowers over the edge with catastrophic consequences for the economy.

An interest rate rise could be seen to bankrupt an already overly indebted government, as well as destroy the economy due to excessive debt levels.

SME’s for example were essentially forced to take on excessive amounts of new debt just to survive during the period of government restrictions.

They now have debt to service, while also grappling with all sorts of inflationary pressures.

Printing more and more money.

As the BOE has become addicted to printing more and more money (currency), the £895 billion money-printing programme is now, it seems, sending inflation spiralling out of control as, not only the quantity of money printing has increased, but also the velocity of money has picked up with the economy open for business once again.

By the end of 2021, the Bank will own an eye-watering £875 billion of Government bonds and £20 billion in corporate bonds.

The overall increase in the money supply doesn’t automatically translate into higher inflation, but the sheer speed and volume of expansion in the money supply has been unprecedented.

The velocity of money is a measure of the number of times a unit of currency is used to purchase goods and services within a given time period.

With velocity now picking up all that newly created currency has come flooding back into the system which seems to be causing rampant inflation and, therefore, higher prices for UK consumers.

Gold.

Gold bullion is an ideal store of value and has a long history of retaining its purchasing power during times of runaway inflation.

There is strong ongoing support and upside for gold as central banks continue stoke the fire that is inflation.