Gold price during a recession, UK 2020.

With the Bank of England issuing stark warnings about the UK economy facing recession and 0.1% interest rates hitting savers hard, where are investors looking to preserve their wealth?

Could it be gold and silver?

When it comes to gold or silver bullion, investors are mainly focused on the gold and silver prices going up or down and how this may fit within an investment portfolio. Gold and silver are not income producing investments like other assets/investments such as property, equities or bonds. Investors normally look to gold and sometimes silver, to help diversify an investment portfolio and can been seen as an ‘insurance policy’ against economic uncertainty.

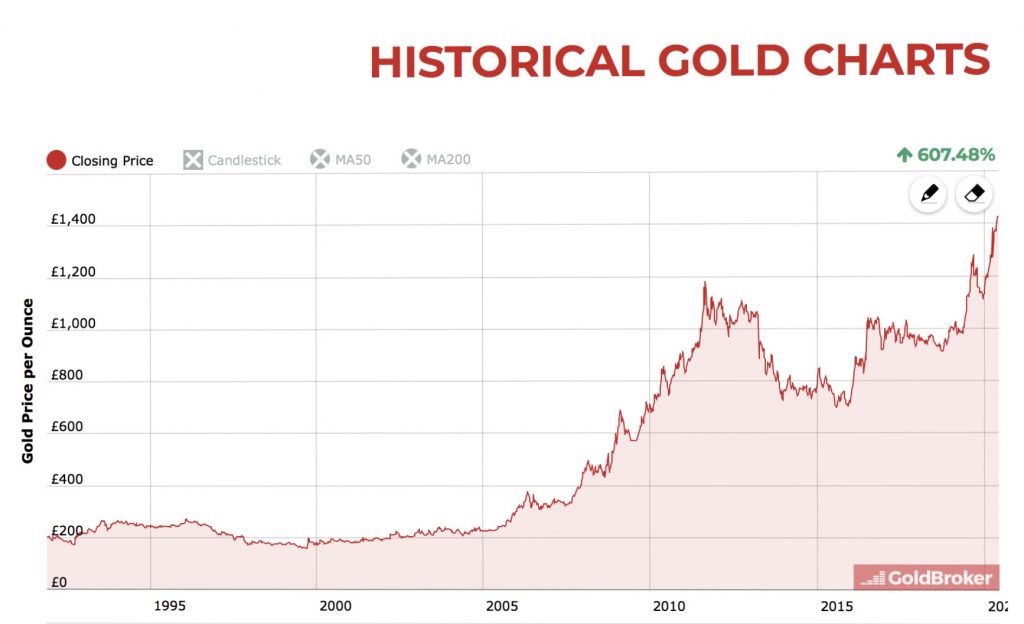

In recent years in the UK it is reasonable to say that gold has had a good run, seeing gold prices continue to rise hitting new highs of £1450 sterling per ounce (May 2020). See gold price chart link on this website for info.

To many investors gold is usually seen as a safe-haven asset. Historically, especially during a recession, investors have rushed into gold as a way to spread risk and diversify their investment portfolio when other investments such as equities are falling.

In recent times, especially since the financial crisis of 2008, you have the added fact that the Bank of England has been facilitating huge amounts of quantitative easing (aka printing money) which, in turn, is devaluing the pound sterling currency.

The reason why gold often holds its value is the fact that gold is limited. Gold is not only naturally scarce, it has high production costs and there is a whole labour process involved. You can’t print gold, but the Bank of England can essentially print the pound sterling out of thin air or type it digitally into existence.

Throughout history, the price of gold has usually done well in times of economic turmoil, geopolitical uncertainty and during recessions.

The reason for this is typically, the stock market will fall during a recession as companies make less profit. Investors then see gold as a safe-haven asset, as gold does not derive its value from a business or credit. Gold is valuable in itself.

Obviously there have been ups and downs in the price of gold. However, you would see gold investment increase in value naturally over time as pound sterling fiat currency continues to devalue.

Source: Historical gold chart www.goldbroker.com Goldbroker all rights reserved.

Gold and recessions in recent history.

A recession is usually defined as a stagnation in growth for over 6 months, or a decline in economic growth for two consecutive months. In a recession everything can fall in value, from property to the stock market and even money itself.

In 1971 president Richard Nixon ended the U.S. dollar convertibility to gold, which essentially ended the Bretton Woods system. This made all major currencies around the world enter into a full fiat currency system, including the UK pound sterling.

Since 1971, there have been series of significant recessions in the UK including:

1973 Oil crisis. Decline of UK industries, high inflation caused industrial disputes over pay.

Early 80s recession. Deflationary government policies, spending cuts, switching a manufacturing economy to a services economy.

Early 90s recession. U.S. savings and loans crisis, high UK interest rate in response to rising inflation.

Great recession. 2008 financial crash, rising commodity prices, U.S. subprime mortgage crisis affecting the UK banking sector.

2020. Entering into another recession due to the current pandemic shutting down the global economy.

As you can see, there has been a succession of regular recessions through recent history for various reasons, usually linked to monetary policy and the price of oil.

In recent times you can see a trend whereby every 10 years or so we enter into some kind of recession, or an equity market bubble bursts, causing major economic issues. Since the last recession of 2008, we were actually due another recession, whether the recent pandemic happened or not.

One underlying theme of these recessions is down to monetary policy, whereby to stimulate the UK economy the Bank of England uses a policy known as ‘inflation targeting’ to try and control the overall rate of inflation. For some time now, the UK government has set a target of 2% inflation that the Bank of England has to try and maintain by adjusting interest rates up or down in order to influence the levels of consumer spending and aggregate demand.

The problem is, due to the current pandemic, the Bank of England has cut interest rates to an incredible 0.1% which is the lowest rate it’s ever been in the Bank of England’s 325 year history.

The Bank of England Economist Andy Haldane, has also recently stated that the Bank of England are examining unconventional monetary policy including negative interest rates (Source: Telegraph May 2020), which would be bad news for savers but good news for borrowers. Where does the Bank of England go from here?

Oil price also seems to be a vital factor linked with recessions, with the link from oil price shooting up or down, causing real economic shocks and, therefore, often a recession follows.

Quantitative Easing (QE) aka printing money.

Since the financial crisis of 2008, the Bank of England has used QE as part of their monetary policy. This involves the Bank of England creating money electronically out of thin air and then buy certain assets such as government bonds from banks. This is intended to avoid deflationary pressures by increasing the money supply. Don’t forget that, by increasing the money supply, they are effectively devaluing the pound sterling.

QE was only supposed to be a temporary measure, however QE has never stopped. Since 2008 the Bank of England has undertaken a series of bond purchases which have built up over the years, starting with £200 billion in November 2009, increasing to a total of £375 billion in July 2012, then £435 billion in August 2016, to a total of £645 billion March 2020 (Source bankofengland.co.uk). Due to the current pandemic QE is still occurring at pace.

The Bank of England uses these monetary policies as an attempt to re-inflate the economy again, usually after the previous recession, therefore creating huge debt bubbles which eventually pop. When the debt bubbles pop, usually this then leads to debt deflation in a short period, leading to a fall in GDP and spikes in unemployment.

When you look back at the last financial crisis of 2008, then the price of gold started to rise dramatically and peaked in late 2011 as investors rushed into gold to preserve their wealth as the equity market was collapsing.

2020 has brought even more uncertainty, with the current pandemic causing major economic issues which is pushing the UK into recession once again.

Gold usually performs well during a crisis, because gold maintains its value while fiat currency or the UK pound sterling continues to lose value. Currency can be printed or typed into existence out of thin air, gold can’t be printed therefore maintains value. Gold is a precious metal and is appealing to investors worldwide. Even central banks across the globe have been buying up gold in vast quantities in recent years and putting it into ‘deep storage’.

If you look back at the price of gold during previous recessions, then investors who diversified some of their investment portfolio into gold would have seen it as a great way to preserve their wealth and possibly even make a healthy return.

While it is not guaranteed that the price of gold would go up during a recession, physical gold can be a beneficial investment during times of economic uncertainty and recession.

BullionVault lets private investors around the world access the professional bullion markets. You can benefit from the lowest costs for buying, selling and storing gold and silver.

4 Grams of FREE Silver on Sign up! VISIT BullionVault

Disclaimer: The articles or blog posts on this website are for general information/opinion purposes only and does not constitute either goldandsilveruk.co.uk or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the articles without first seeking independent professional advice. Care has been taken to ensure that the information in the articles are reliable; however, goldandsilveruk.co.uk does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such.

The site goldandsilveruk.co.uk will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in these articles or blog posts and any action taken as a result of the opinions and information contained in these articles or blog posts is at your own risk. All rights reserved www.goldandsilveruk.co.uk

This website/blog may generate revenue through paid sponsorships, advertising, paid insertions and affiliate partnerships.

goldandsilveruk is a precious metals enthusiast who wants to give authentic, clear, simple, transparent information and opinion to readers. Compensation may influence advertising content, topics or posts made on the blog. However, all paid and/or sponsored content and advertising space and posts would be identified.

All facts and claims made in posts should be independently verified with the manufacturer or provider. If a conflict of interest exists in the content, it may not always be identified.

Changes made to the policy will be identified on disclaimer page and in the general privacy policy and T&C.