Table of Contents

Gold in the UK.

Gold UK. Bullion is often seen as a durable and reliable investment due to its unique properties.

It’s finite supply ensures its enduring value.

Gold is scarce.

Gold is scarce, which prevents the market from being flooded with gold.

Gold is a reliable store of value.

Physical gold bullion has been a strong and reliable store of value for centuries.

Gold can store your wealth outside of the UK banking system.

Physical gold gives you the opportunity to store your wealth outside of the UK banking and economic systems. This makes gold ideal for UK investors looking to preserve wealth against future recessions, market fluctuations or bank failures.

Gold is a safe haven investment.

The price of gold often rises in times of economic uncertainty as investors seek safe haven investments such as gold.

Gold is recognised globally.

Gold bullion is recognised and used all over the world and as such, can be exchanged for goods, services, currency and more. It is easily liquidated.

Gold will always be in demand.

Gold has and always will be in demand as a reliable store of value for investors all over the world.

Gold will never go to zero.

The price of gold will never go to zero like many paper assets such as stocks.

Gold coins.

BullionVault lets private investors around the world access the professional bullion markets. You can benefit from the lowest costs for buying, selling and storing gold and silver.

4 Grams of FREE Silver on Sign up! VISIT BullionVault

Gold coins are an ideal alternative to printed fiat currency.

Popular coins such as the British Britannia and British Sovereign, both currently minted by The Royal Mint, are very attractive gold coins not only in physical form but also from an investment point of view. These specific coins for example are exempt from Capital Gains Tax in the UK.

There are many investment grade gold bullion coins from across the world, such as the South African Krugerrand coin, the U.S. American Eagle coin, Austrian Philharmonic Coin, Australian Nugget coin, Canadian Maple Leaf coin, Chinese Panda coin and more.

Bullion coins can be a great way to turn an investment into a fantastic hobby, collecting gold coins from all over the world.

Collecting limited edition gold coins or standard Britannia bullion coins from the Royal Mint is a good place to start.

Gold bars.

Gold bullion bars can be an excellent option when it comes to buying bullion grade gold.

Gold bars are a superb way to ensure a low premium on the purchase price of gold bullion. Although large bars usually have smaller premiums, smaller bars allow flexibility when the time comes for you to sell your gold.

Gold in an investment portfolio.

Physical gold bullion is an excellent option for savvy investors to diversify any investment portfolio.

Gold is TAX efficient.

Physical gold bullion can often be tax efficient when leaving or passing on wealth to family or friends.

Gold is private.

Physical gold bullion is one of the only forms of private investment left in these modern times.

Gold investment.

BullionVault is the world’s largest online investment gold service taking care of $3 billion for more than 85,000 users.

4 Grams of FREE Silver on Sign up! VISIT BullionVault

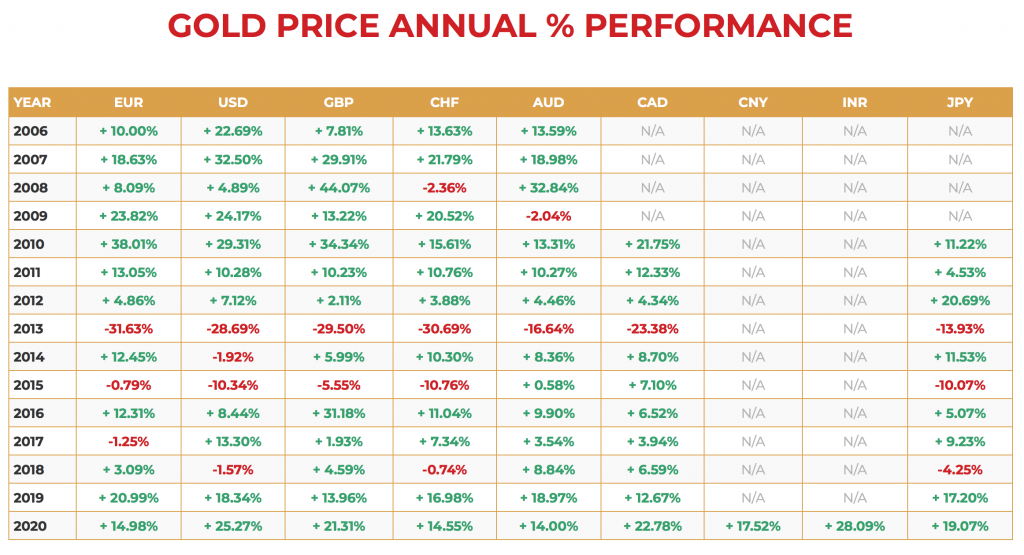

Precious metal prices can be volatile and the spot price of gold is no exception. Over time, gold prices can fluctuate, prices can go up as well as down.

When gold is at an all-time price high, is that necessarily the best time to buy gold bullion? This website and blog aims to give you as much information as possible on gold, investment, news and the markets so you can make your own informed decisions.

Enjoy the gold investment journey.

Read more about reasons to invest in gold here.

Disclaimer: The articles or blog posts on this website are for general information/opinion purposes only and does not constitute either goldandsilveruk.co.uk or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the articles without first seeking independent professional advice. Care has been taken to ensure that the information in the articles are reliable; however, goldandsilveruk.co.uk does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such.

The site goldandsilveruk.co.uk will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in these articles or blog posts and any action taken as a result of the opinions and information contained in these articles or blog posts is at your own risk. All rights reserved www.goldandsilveruk.co.uk

This website/blog may generate revenue through paid sponsorships, advertising, paid insertions and affiliate partnerships.

goldandsilveruk is a precious metals enthusiast who wants to give authentic, clear, simple, transparent information and opinion to readers. Compensation may influence advertising content, topics or posts made on the blog. However, all paid and/or sponsored content and advertising space and posts would be identified.

All facts and claims made in posts should be independently verified with the manufacturer or provider. If a conflict of interest exists in the content, it may not always be identified.

Changes made to the policy will be identified on disclaimer page and in the general privacy policy and T&C.