Has silver gone mainstream?

However you feel about the recent Silver Squeeze news, it is hard to deny that it has brought mainstream attention to gold and silver, as well as introducing the precious metals market to a whole new mass audience.

This recent tweet from ‘quote the raven’ sums it up quite nicely:

“The thing is that no matter what happens with #SilverSqueeze, a lot of younger people are for the first time informing themselves that metals are the only true real money. That realization sticks for life, even when squeezes end. This is a red pill moment for many & it’s beautiful”

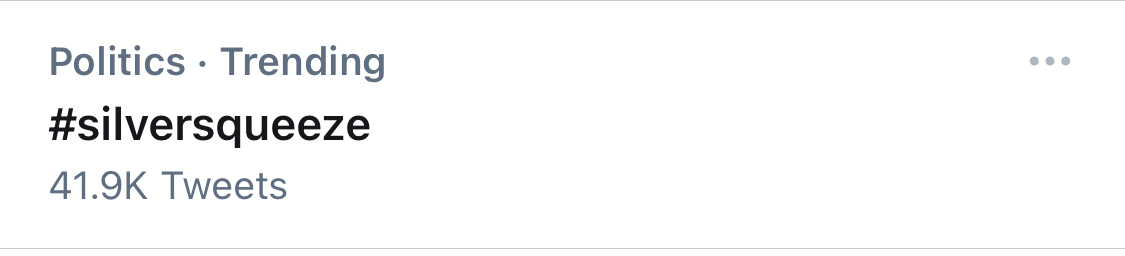

The hashtag #Silversqueeze started trending on twitter with many other high profile names exposing the fact that some banks have huge short positions in silver. This is bringing the silver story to the masses, including day traders and crypto fans who have massive influence on the markets.

BullionVault lets private investors around the world access the professional bullion markets. You can benefit from the lowest costs for buying, selling and storing gold and silver.

Many media outlets such as the BBC, CNBC, Barron’s, Bloomberg and many more, arguably have added to the retail frenzy whereby silver actually broke above $30 an ounce at one point.

How long retail investors stick to the silver trade is hard to tell, however, even if this initial rally fades, this has brought a relatively niche precious metals market to the attention of the worlds media.

It is fair to say that silver in particular has been undervalued for years and commodities in general are undervalued compared to the wider market, however this is starting to change.

Many people feel like something is building momentum right now. The Reddit/GameStop story has exposed the power of the short squeeze and has turned mass media attention onto the manipulation and games played by Wall St and the big banks.

This has now spilt over to the precious metals sector with more and more people now discovering how undervalued precious metals are, especially silver.

Many in the precious metals sector have reason to believe that the paper silver market is at least 250 times the size of the physical market. Read more here.

Banks have been heavily “net short” silver for years, this is no secret within the precious metals community.

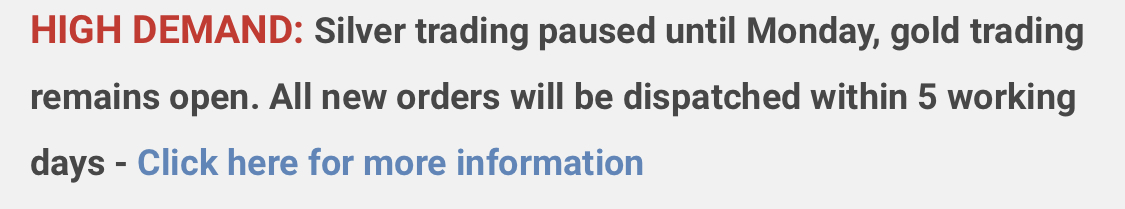

Recently sales of physical silver have spiked with many dealers reporting shortages and some even stopped sales of silver over the weekend.

Gold and Silver UK has also had a surge in DM’s on social media platforms, particularly instagram from mainly younger investors interested in gold and silver and the wider precious metals market.

Silver has already had a great run YTD with silver rallying more than 40%, however, silver is still way off previous all-time highs.

Chart by GoldBroker. All rights reserved.

With central banks flooding markets with liquidity, silver also stands to gain as a hedge against inflation. Easy money policies devalue fiat currencies which means it takes more currency to buy an ounce of silver.

Read more about the fundamentals of silver in 2022 here.

At some point there is going to be a tipping point once gold and silver hit a certain price, extreme FOMO is going to kick in.

Many investors are going to be scared. Those who have fiat/paper wealth are going to want real tangible assets.

The physical gold/silver market is small compared to the stock/bond market. This could trigger one of the biggest wealth transfers in history.

Are you going to be on the right side of this wealth transfer?

BullionVault. It’s free to open an account with BullionVault and registration takes less than a minute. There’s no obligation to trade.