Table of Contents

The War on Cash, Central Bank Digital Currency and Gold.

The move towards a cashless society has ramped up another gear, with the recent announcements from central banks across the globe that they are looking to introduce the highly controversial Central Bank Digital Currency.

Central Banks including the Bank of England, the European Central Bank and the Reserve Bank of Australia, recently tweeted the following:

“We’ve started exploring the possibility of launching a digital euro”

Christine Lagarde (President of the European Central Bank).

“We are partnering with Commonwealth Bank, National Australia Bank, Perpetual and ConsenSys Software to explore the potential use and implications of a wholesale form of central bank digital currency using distributed ledger technology.”

Reserve Bank of Australia.

The Bank of England also recently released a ‘discussion paper’ on Central Bank Digital Currency as, “CBDC could present a number of opportunities for the way that the Bank of England achieves its objectives of maintaining monetary and financial stability.”

The Bank of England governor Andrew Bailey, has also said the central bank has been looking into the possibility of issuing a digital currency.

China seems to be way ahead of the game, as it has made substantial progress on establishing a digital version of the renminbi (the official currency of China) known as Digital Currency/Electronic Payment (DCEP).

Trials have already started in several cities, including Shenzhen, Suzhou, Chengdu, as well as a new area south of Beijing, Xiong’an, and areas that will host some of the events for the 2022 Beijing Winter Olympics.

Although not officially confirmed, screen shot pictures have been emerging online of the new digital currency.

It seems to work in a similar way to other popular payments industry apps or digital wallets, such as PayPal or CashApp.

What is Central Bank Digital Currency (CBDC)?

In essence CBDC would be a representation of a country’s currency, but using digital tokens and blockchain technology.

CBDC would be centralized and regulated by a country’s monetary authority, unlike other cryptocurrencies such as Bitcoin which are decentralised.

Why should you care about CBDC?

There has been a lot of debate about exactly how this new centralised digital currency would be issued to citizens and the level of control central banks have, but essentially it comes down to a few key points.

CBDC can track every transaction easily.

It is a much easier method for central banks to control the whole monetary system by being able to easily track each and every transaction.

It would be ‘programmable’, meaning it could programmed to restrict what kind of items you could buy. It could automatically take tax payments; it could also be programmed to give negative interest rates to savers.

This digital currency would also be used as a payment method to compete with the ever growing popularity and desire from the public for cryptocurrency, such as bitcoin for digital payments.

Many also consider CBDC as an attack on freedom and liberty, as you would no longer be able to make a transaction/payment anonymously.

All your transactions would be tracked. Having a central system knowing your whereabouts, spending habits and lifestyle choices tracked could be a concern for many.

Of course, these bankers and institutions will talk about convenience for consumers, lower costs, law enforcement and clamping down on tax evaders and criminals, while at the same time not mentioning any of the above consequences.

The war on cash is nothing new.

The war on cash and the debate about the pros and cons of a cashless society have been going on for years.

However, due to the recent global crisis leading to cash payments being restricted or even banned in many retail outlets, this is leading to cash usage falling and payment cards or contactless payment being the norm.

The ability to use cash is becoming more difficult, as it seems the moves towards banning the use of cash has suddenly become more likely.

What the war on cash is doing to your money.

It is fair to say that the World is in a major economic crisis.

The global economy is sliding into recession and central banks are using more and more unconventional monetary policies, such as the use of negative interest rates and quantitative easing (printing new money) to stop the financial system from imploding.

The World’s negative yielding debt just hit a new new record, $17.5 Trillion. (Source: Bloomberg)

In order to continue to ‘re-inflate’ the financial markets, more and more ‘stimulus’ is needed, with central banks continuing rampant quantitative easing programmes.

The UK alone just added another £150 billion into its failing economy:

The burden of debt.

The U.S. national debt alone is now over $27 Trillion, with a debt to GDP ratio of 128% (USdebtclock.org).

The UK national debt is over £2 Trillion (NationalDebtClock.co.uk).

Countries and markets across the globe are now addicted to this easy money.

Negative Interest Rates.

Astonishingly some countries such as Switzerland, Sweden and Japan amongst others, now have a negative interest rate. Until recently negative rates have never occurred before in history.

This could mean some savers, who save their money in a standard banking account, could see account balances shrink as depositories are essentially charged for the privilege of depositing their money in bank accounts.

The simplest way to avoid these negative interest rates, which would be destroying your saving and purchasing power, would be to simply take all your money out of an account using cash withdrawals and save it in cash. At least you wouldn’t be losing money.

However, if there is no cash, then all citizens would be forced into having a digital account.

Therefore, there would be no escape from negative rates, which is really a form of hidden tax.

IMF (International Monetary Fund) are calling for a ‘Bretton Woods’ style re negotiation of the monetary system.

The IMF (International Monetary Fund) recently released a video entitled ‘a new Bretton Woods moment’ essentially calling for a ‘Bretton Woods’ style re-negotiation of the monetary system.

Here is a section of the video:

What was the Bretton Woods agreement?

Towards the end of World War 2, it was clear that the world needed a new monetary system.

In July 1944, 730 delegates from all 44 Allied nations gathered at the Mount Washington Hotel in Bretton Woods New Hampshire, United States, for the United Nations Monetary and Financial Conference, also known as the Bretton Woods Conference.

The United States, which controlled two thirds of the world’s gold, insisted that the Bretton Woods system rest on both gold and the U.S. dollar.

Essentially, countries could settle their international accounts in dollars. Those dollars could be exchanged into gold at an exchange rate of $35 dollars per ounce redeemable by the U.S. government.

The U.S. was committed to backing every dollar with gold, and all other currencies around the world were pegged to the dollar.

However, on August 15th 1971, president Richard Nixon ended the U.S. dollar convertibility to gold.

This took away the dollar convertibility to gold which, in turn, made all currency worldwide fiat currency.

The New Bretton Woods.

However ‘a new Bretton Wood moment’ pans out, you can pretty much guarantee that Digital Currency will be a key factor in the negotiations.

The desire and need for physical cash by these elites of the financial system is now non existent, as they have found a brand new way to create, track and control the monetary system via Central Bank Digital Currency.

How this plays out is hard to tell.

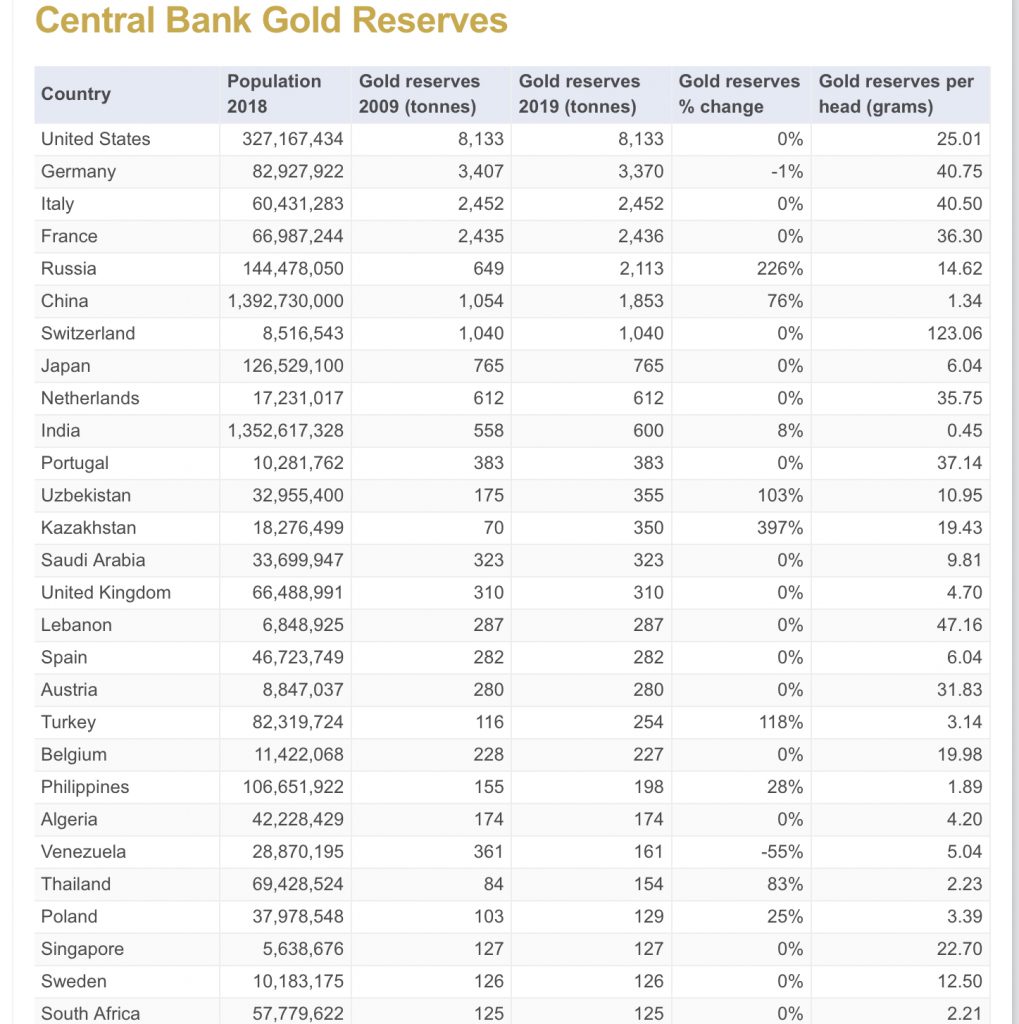

Back in 1944 there was an obvious winner, America as they had the most power after the war and the most amount of gold.

This time it is very different, the world order is now very complex, with China becoming a major player.

Will gold still be a factor in this re-negotiation?

BullionVault lets private investors around the world access the professional bullion markets. You can benefit from the lowest costs for buying, selling and storing gold and silver.

4 Grams of FREE Silver on Sign up! VISIT BullionVault

No one knows for sure, but the fact is, over the last few years or so countries and central banks across the world have buying up and stock piling vast amounts of gold, especially in China and Russia.

This could be a key indication that gold could still play a major part in any monetary renegotiation.

What if cash was completely banned?

There is no certainty that cash would ever be banned.

However, there is now a strong possibility this could happen and cash holdings could eventually be extinct.

For example, The European Central Bank has already discontinued the production of new 500 euro notes.

You only have to go to your local high street and see that lots of stores and coffee shops now do not even accept cash transactions as a payment method anymore. This war on cash trend has already started and is being exacerbated by the current worldwide health crisis.

If every citizen has a CBDC wallet downloaded on their phone as an app, then a central bank and government can see every single transaction you will ever make, especially if there is no cash whatsoever.

Essentially, every transaction would have to go through the central bank and government, this would give them an immense amount of power and control and could be seen as an attack on civil liberties.

Obviously, there is no guarantee this will actually happen, but there are more and more signals that are pointing towards this type of monetary policy.

How gold can protect your wealth and financial privacy.

BullionVault is the world’s largest online investment gold service taking care of $3 billion for more than 85,000 users.

4 Grams of FREE Silver on Sign up! VISIT BullionVault

You could take immediate action by choosing to exit this monetary system, and defend the purchasing power of your savings.

Gold is not controlled by a central entity or central government.

Gold can store your wealth outside of the banking system, therefore protecting your wealth from negative interest rates.

Gold can protect your purchasing power against the increase of the fiat currency supply, which generates depreciation of the value of fiat currency such as the pound sterling.

Gold is a much more private form of preserving wealth.

Physical gold is one of the very few truly private investments available today.

With gold, you have full control over your wealth.

Conclusion.

If you are an honest citizen, then your wealth could be vulnerable.

Your wealth could become eroded through negative interest rates, limits on cash withdraws and transfers, loss of privacy, account freezes, restricted items you can buy and more.

Gold can protect your wealth from this type of monetary confiscation in a cashless society.