Is it reckless not to have gold and silver in your portfolio? In simple terms, precious metals such as gold and silver have historically been a hedge against currency weakness, stock market volatility, political instability and even the real risks of an economic collapse.

With this in mind, gold and silver bullion can be useful to diversify any investment portfolio as they are partially uncorrelated with stocks, bonds and even property investment.

When certain assets are rising other assets are declining, this can create opportunities to put some investment into these undervalued assets. A smart investor will identify undervalued or reasonably priced assets in all sorts of different areas including precious metals.

Table of Contents

Gold and silver have no credit risk.

Physical gold and silver bullion has no credit risk as they do not rely on another party for their value. Gold and silver doesn’t rely on another party for its worth.

Bonds depend on a borrower to pay interest, rental properties depend on tenants to pay rent, stocks depend on reliable companies and profits, gold and silver bullion does not depend on these other factors, as the store of value is retained within the precious metal itself.

Gold and silver are good at holding their value over the long-term against inflation.

It is worth noting that gold and silver do not produce cash flows like investing in a profitable business or an interest-paying bond.

However, historically, both gold and silver are very good at maintaining their value over long periods of time, preserving one’s purchasing power against inflation.

Central Banks always set an inflation target, usually around 2%.

Therefore, your money, or more accurately your currency, is guaranteed to go down in value every year.

You might look at savings accounts and government bonds to give some kind of returns, but with interest rates at historic lows these savings options barely keep up with inflation.

During these times of very low interest rates, the interest on saving accounts and bonds may be lower than inflation, this means that those people who are saving currency are essentially losing purchasing power.

Gold and silver might be a better place to allocate some money for the longer term. Although these metals can be volatile, historically both gold and silver have been a reliable store of wealth over long periods of time.

Currency risk.

The risk of the value of the currency in your country collapsing is real and has happened many times in the past, just ask the people in places such as Argentina, Turkey, Nigeria, Greece and others.

Recently the Turkish government has tried to ban cryptocurrency payments, and is also trying to encourage citizens to sell their gold to support a failing currency as the Turkish Lira continues to lose value.

Those people who have gold have been able to protect their purchasing power and have benefited greatly from the carnage in their domestic economy while fiat currency collapses around them. This highlights the fact that gold is real money.

Over the past 5 years, gold has outperformed the Turkish Lira +300%.

Economic crisis.

Both gold and silver can be stored outside of the traditional banking system.

As an example in 2015 during the economic crisis in Greece, there was a run on the banks.

This resulted in citizens being restricted on the amount of cash they could withdraw from their bank accounts. A limit of 60 euros per day was put in place and as you can imagine, huge lines started forming at ATM’s just to withdraw the minimal sums of cash that were allowed at the time.

In times of economic crisis, it can definitely be of benefit to have hard assets such as gold and silver on hand.

As history proves, you can’t always rely on your local bank or online banking networks to provide sufficient funds during times of crisis.

Money printer goes ‘Brrr’.

Most central banks around the world keep printing more units of currency, and since 2020 the numbers have literally gone off the charts.

QE (Quantitative Easing AKA printing money) was only supposed to be a temporary measure, however QE has never stopped. Since 2008 the Bank of England has undertaken a series of bond purchases which have built up over the years, starting with £200 billion in November 2009, increasing to a total of £375 billion in July 2012, then £435 billion in August 2016, moving up to £645 billion in March 2020, then £745 Billion in November 2020 with a total now £895 billion in November 2020. Due to the current situation QE is still occurring at pace.

In November 2008 the FED (Federal reserve) started buying up financial assets totalling $600billion.

By March 2009 the FED held $1.75trillion and peaked at $2.1trillion. In November 2010, the FED announced another round of QE, buying $600billion of Treasury securities. QE3 (a third round of quantitative easing), was then introduced when the FED announced a new $40billion monthly open-ended bond purchasing programme. By December 2012, this was increased to 85billion per month. Purchases were halted in October 2014 by then accumulating $4.5trillion in assets, (source Wikipedia).

U.S. Congress recently approved a $1.9 Trillion stimulus package which was signed into law by President Joe Biden on March 11, 2021.

Ongoing QE programmes into 2021 are now pushing the FED balance sheet over $7trillion.

Money supply is expanding.

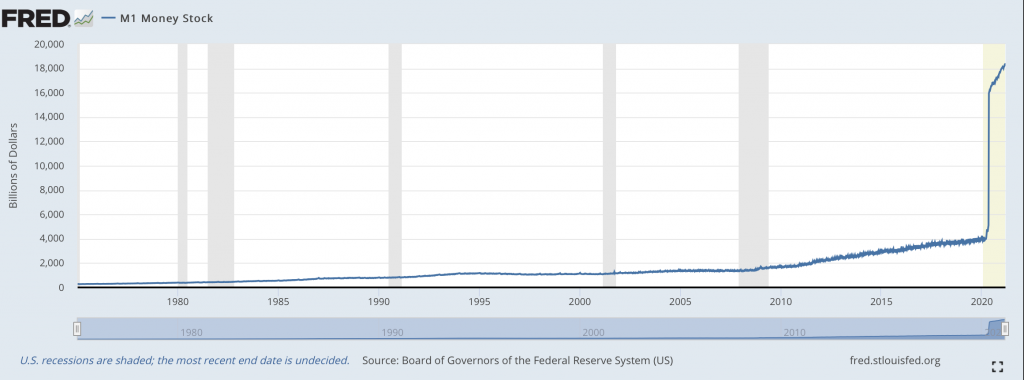

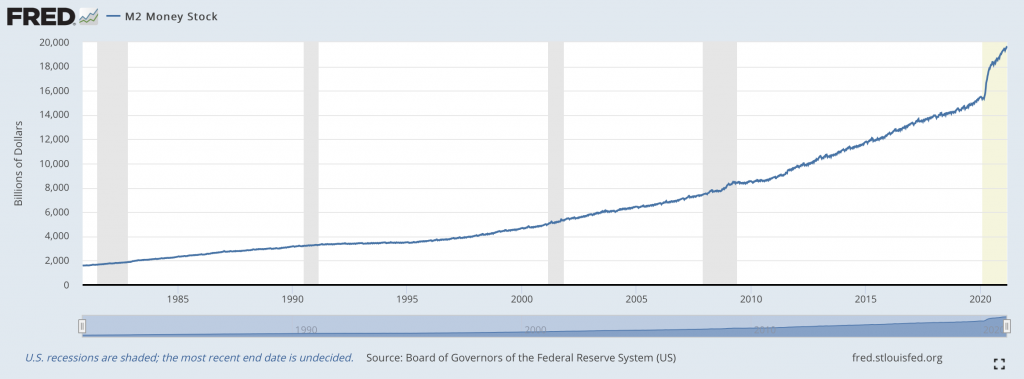

M1 money supply includes those monies that are very liquid such as cash, checkable (demand) deposits, and traveller’s cheques. M2 money supply is less liquid in nature and includes M1 plus savings and time deposits, certificates of deposits, and money market funds.

In the U.S., the M1 money supply has increased by over 55% since February 2020.

The overall increase in money supply does not automatically translate into higher inflation, but the sheer speed and volume of expansion in the money supply is somewhat concerning.

You just have to look at Zimbabwe which saw extremely rapid increases in its money supply, which then led to rapid and out of control increases in prices, this is known as hyperinflation.

There is now a real risk of major inflation or stagflation (slow economic growth and relatively high unemployment and at the same time accompanied by rising prices) in the not so distant future.

In theory over the long term, the price of gold should keep up with the growth of money supply but with obvious volatility on the way.

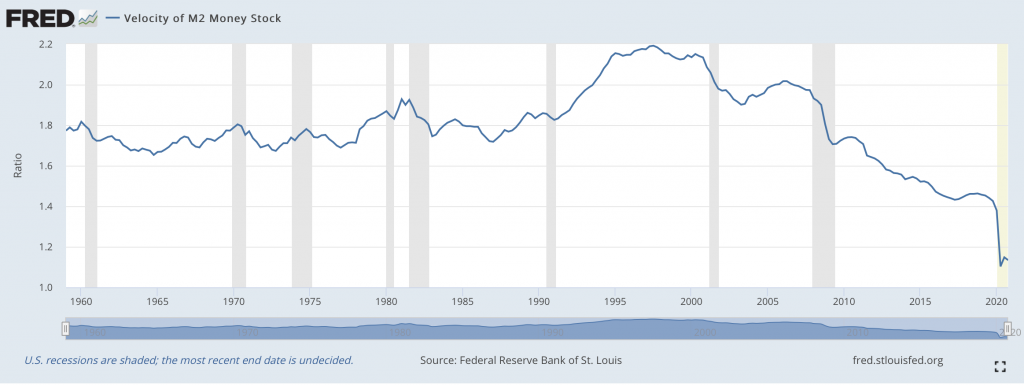

The velocity of money.

The velocity of money is a measure of the number of times a unit of currency is used to purchase goods and services within a given time period.

If the velocity of money is increasing, then transactions are occurring between individuals more frequently and vice versa.

As you can see by the chart below, the velocity of money in the U.S. has recently fallen dramatically, with people worried about the economy and people tend to be saving their cash.

This is particularly interesting, as at this moment in time, even though the money supply is expanding at an alarming rate, the velocity of that money is slowing down, therefore the money is not being spent or circulated in the real economy.

Eventually however, velocity will pick up and all that newly created currency will come flooding back, potentially causing rampant inflation.

Silver.

Silver is used in pretty much every electronic device out there, it also has a wide range of industrial uses such as in solar panels, glass, dental equipment and more. It is more of a functional metal than gold as gold is mainly used for jewellery and bullion, and only a small percentage of gold is used for industrial or technological use.

Silver plays a key role in our modern lives, as it is a major component for the technology and green energy sectors. These sectors are set to explode in 2021 and beyond as investment continues to pile in, not only from the private sector but also from government green initiatives.

If industry and governments want to continue to expand their green energy goals, then there is no other way around it – they have to buy silver!

Industrial buyers will simply have to pile in as the price of silver continues to go up, they will need silver to produce green products such as electric vehicles.

There is also an added problem in the fact that physical supply has been declining due the operational shutdowns of gold and silver mines in response to the recent government restrictions.

Is silver the most undervalued asset on the planet right now? Read more here.

Silver is more volatile than gold. That means that opportunistic investors can potentially make a lot more money as silver often outperforms gold in a bull market.

Different options when investing in gold and silver.

There are many different options when it comes to getting some exposure to precious metals.

Physical Gold and Silver Bullion bars and coins.

The key method for gold and silver investing is to simply buy some physical gold and silver coins or bars.

This can be the safest and most straight forward way to invest in Bullion. You can buy some from a reputable bullion dealer and hold it in a safe and secure place.

Once you start getting to large amounts, it’s quite unsafe to store physical gold and silver bullion at home. For large amounts it’s important to store bullion professionally with all the security and insurance measures in place to give you ultimate peace of mind.

With many websites to choose from, Gold and Silver UK has put together a some recommended websites where you can buy gold and silver bullion online, securely.

These sites offer gold and silver bullion stored in leading gold and silver vaults, 100% allocated in your name, as well as some offering bullion in the form of coins or bars delivered to your home.

BullionStar.

BullionStar offers real physical gold and silver bullion – allocated and segregated – with full legal ownership.

You can hold both bullion and cash funds on your BullionStar account as well as the ability to buy, sell or withdraw your bullion 24/7 online.

You have the opportunity to view and analyse your bullion portfolio anytime and view pictures of your bullion uploaded to your account.

BullionVault.

At BullionVault you can buy gold and silver in 1 gram increments within LBMA approved wholesale bars.

No VAT or Sales Tax, No delivery costs as the gold, silver & platinum is stored in professional vaults, you choose where.

Professional vaults mean you pay the lowest storage & insurance costs.

You are able to buy & sell gold and silver 24/7 and instantly have funds back in your account ready to be withdrawn.

GoldBroker.

With GoldBroker, you can purchase gold and silver bullion produced by recognized refiners certified by the London Bullion Market Association, such as the United States Mint, Asahi Refining and the Royal Canadian Mint.

Bars never leave the professional chain from the moment of fabrication. Traceability guarantees your precious metal’s authenticity and purity. Therefore, any investment maintains its maximum resale value.

Vaultoro. Buy gold and silver with crypto.

Vaultoro is an online exchange based in the UK that allows it’s users to trade Bitcoin or DASH for physical gold or silver and vice versa, without the need to use a fiat currency or a bank account.

Vaultoro offers users instant access to the gold/silver market.

This is a truly unique online exchange, specifically trading BTC/DASH and gold/silver bullion.

ETFs.

Exchange-traded funds (ETFs) are an easy way to get exposure to the price of gold and silver, they are extremely liquid, and you can buy or sell them within your brokerage account.

However, ETFs (Exchanged-traded funds) are investment funds trading on stock market exchanges just like stocks. These funds reproduce the performance of assets, stocks (stock indices), currencies, commodities or bonds. They trade near the value of their underlying assets.

ETFs are essentially designed to track the gold price using complex derivatives. In most cases you do not own or have access to the physical metal which bring up all sorts of counterparty risks.

Gold and Silver Miners.

As physical gold and silver do not produce cash flow, miners on the other hand do produce cash flows and can often pay dividends.

Although, as the price of gold and silver goes up there are some big gains to be had as profits can jump, there are some risks with miners such as if the price of gold stays low for a long period of time, there could be a risk of the company going bankrupt before the price of precious metals begins to rise again.

You really have to do your research into the miners space before investing, although there is potential for large gains, overall miners can be a very risky investment.

Royalty Companies.

Royalty companies finance mines. They provide the investment to develop a mine in return for gold and silver at a reduced market price, or most often get a percentage of the overall output.

This can be a less risky way to invest in gold and silver compared to the miners themselves.

Conclusion.

Is it reckless NOT to have gold and silver in your portfolio? Famous hedge fund billionaire Ray Dalio also recommends having at least a small percentage gold bullion as part of his “all weather” portfolio diversification strategy.

Gold and silver is accepted as a store of value all over the world and has maintained its purchasing power for thousands of years.

Owning at least some gold and silver in your portfolio can be seen as the ultimate insurance policy as they are a separate asset class from stocks, bonds and property.

While everyone seems to be buying wildly overvalued tech stocks and crypto, gold and silver can be used as the physical store of wealth to weather any financial storm.

Disclaimer: The articles or blog posts on this website are for general information/opinion purposes only and does not constitute either goldandsilveruk.co.uk or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the articles without first seeking independent professional advice. Care has been taken to ensure that the information in the articles are reliable; however, goldandsilveruk.co.uk does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such.

The site goldandsilveruk.co.uk will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in these articles or blog posts and any action taken as a result of the opinions and information contained in these articles or blog posts is at your own risk. All rights reserved www.goldandsilveruk.co.uk

This website/blog may generate revenue through paid sponsorships, advertising, paid insertions and affiliate partnerships.

goldandsilveruk is a precious metals enthusiast who wants to give authentic, clear, simple, transparent information and opinion to readers. Compensation may influence advertising content, topics or posts made on the blog. However, all paid and/or sponsored content and advertising space and posts would be identified.

All facts and claims made in posts should be independently verified with the manufacturer or provider. If a conflict of interest exists in the content, it may not always be identified.

Changes made to the policy will be identified on disclaimer page and in the general privacy policy and T&C.