Table of Contents

Is the value of money going down?

The Illusion of Rising Prices: A Devaluation of UK Currency

In a world where inflation becomes a part of daily life, it’s easy to fall into the trap of believing that everything is getting more expensive. So is it actually the value of money going down?

We witness the prices of goods and services steadily climbing, from food and fuel to housing and energy bills. However, it’s essential to recognise that what’s truly happening isn’t a sudden surge in the cost of living but a consistent devaluation of the currency we use to measure value.

Inflation: A Silent Eroding of Purchasing Power

Inflation is often described as a silent and insidious force, quietly eroding the purchasing power of the money in your wallet.

When we see prices rising, it’s not that the goods and services themselves have become inherently more valuable; rather, it’s the currency we use to transact that has lost its worth. To understand this phenomenon, we need to delve into how inflation works.

The Mechanics of Inflation

Inflation occurs when the supply of money in an economy surpasses the growth of its goods and services. When central banks introduce more money into circulation, whether through monetary policy or stimulus measures, the amount of currency increases. As a result, the value of each unit of currency decreases. This decrease in currency value is reflected in the form of rising prices for goods and services.

Consider this simple example: if there are £1000 in circulation, and the total value of all goods and services in the economy is also £1000, then the value of each pound is £1. However, if the central bank injects an additional £1000 into the economy without a corresponding increase in the value of goods and services, the total money supply doubles to £2000. Now, each pound is only worth £0.50p in terms of purchasing power.

The Effect on Everyday Life for UK citizens

In everyday life, this devaluation of currency becomes evident when we see the prices of essential items such as food, fuel, and housing rising steadily or sometimes sharply.

It seems as though these goods and services are becoming more expensive, but in reality, it’s the diminishing value of the currency that’s driving the apparent increase in prices. As your money becomes worth less, you need more of it to purchase the same goods and services.

Preserving Wealth with Gold and Silver

This is where the timeless allure of precious metals like gold and silver comes into play.

Unlike fiat currencies, these metals have intrinsic value and are not subject to the whims of inflation. Their scarcity and resistance to devaluation make them a reliable store of wealth.

When you hold gold or silver, you’re essentially safeguarding your wealth against the erosion caused by inflation. As the value of fiat currency diminishes, the value of these precious metals remains steady or even appreciates, making them a prudent choice for preserving your purchasing power over time.

The Bank of England is telling you directly that your money will be worth less.

When central banks such as the Bank of England announce that they are aiming for an inflation rate of say 2% they are actively telling you that your purchasing power will be eroded by 2% each year compounded.

Have you ever stepped back to think about that?

Inflation can create the illusion that prices are continually rising.

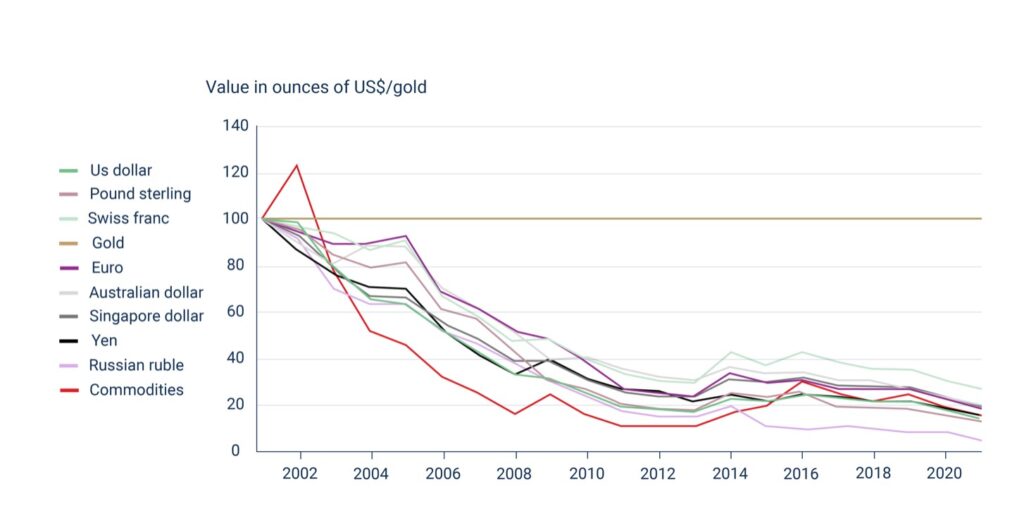

Inflation can create the illusion that prices are continually rising, making it seem as though the cost of living is escalating. However, the reality is that it’s the value of the currency that’s diminishing. Understanding this distinction is crucial for making informed financial decisions. Precious metals, with their time-tested ability to preserve wealth, offer a hedge against the devaluation of currency and serve as a safeguard for your hard-earned money in an era of inflation. So, next time you see prices rising, remember that it’s not everything getting more expensive—it’s your currency losing its value.

Gold vs the Declining UK Pound

In a world of ever-fluctuating financial markets and economies, the age-old debate of what constitutes “real money” takes centre stage. Gold and silver, the timeless champions of wealth preservation, have outshone fiat currencies over time. In this post, we’ll delve into how the British pound has devalued in comparison to gold, emphasising the significant losses in value that occurred over the past 20 and 80 years. We’ll also explore the underlying reasons behind this depreciation.

The Decline of the UK Pound. Is the value of money going down?

To grasp the extent of the British pound’s devaluation, we must turn our attention to the numbers. Let’s examine how much value the pound has lost against gold since 2000 and 1920.

Source: https://www.goldavenue.com

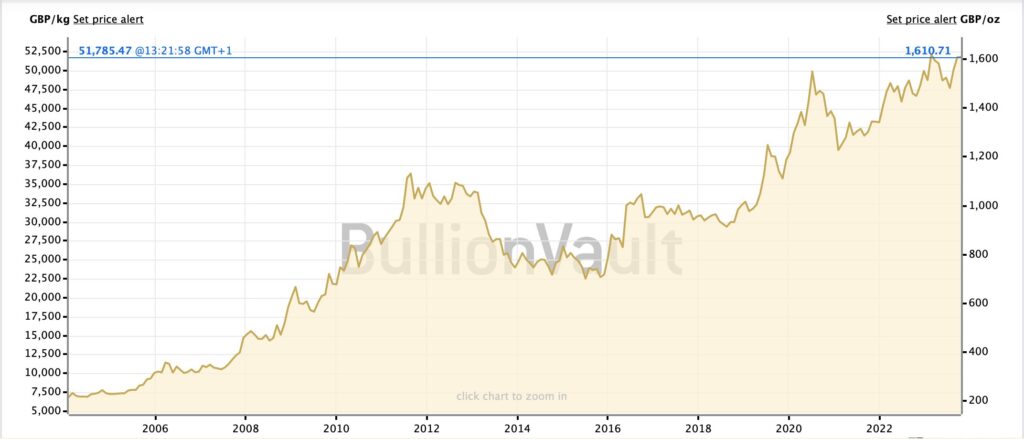

20-Year Perspective Gold vs UK Pound: 2000-2020

So is the value of money going down? Over the past two decades, the British pound has faced considerable devaluation compared to gold. In 2000, an ounce of gold could be obtained for a significantly lower amount of pounds than it would cost in 2020. The precise figures reveal a stark contrast in value:

In 2000, an ounce of gold was priced at approximately £200.

By 2020, the same ounce of gold had surged to around £1,300.

Now in 2023 the value is hovering around £1,610.

This means that the pound had lost a substantial portion of its value over this 20-year period when measured against the enduring stability of gold. It’s essential to note that this devaluation has consequences for individuals who save their wealth in pounds.

80-Year Perspective Gold Vs UK Pound: 1940-2020

Zooming out to an even broader historical view, we can examine how the British pound has fared against gold over the past 80 years, from 1940 to 2020. The results are equally astonishing:

In 1940, an ounce of gold could be acquired for a mere £4.

By 2020, the same ounce of gold had skyrocketed to around £1,300.

This staggering increase in the price of gold over eight decades underscores the remarkable preservation of wealth that gold has offered in contrast to the persistent decline of the pound.

Understanding the Devaluation

Now, let’s delve into the reasons behind the devaluation of fiat currencies like the British pound. In the current monetary system, fiat currencies can theoretically be printed without limitation, leading to inflationary pressures. The recent economic turbulence we’ve witnessed serves as a perfect example.

Recent Monetary Expansion

Over the past year, we’ve witnessed a surge in money supply due to unprecedented levels of monetary expansion aimed at stimulating economies. Governments around the world have implemented massive stimulus packages to counter the economic challenges posed by the global pandemic.

This surge in money supply has, in turn, fuelled concerns about inflation. When central banks inject vast sums of money into the economy, it can lead to an oversupply of currency, diminishing its purchasing power. As a result, consumers witness rising prices for goods and services, while the real value of their savings dwindles.

Gold as a Store of Wealth

In such uncertain economic times, gold emerges as a clear winner. Its intrinsic value, scarcity, and resistance to inflation make it a reliable store of wealth. While fiat currencies can be printed without restraint, the supply of gold is limited, leading to its gradual but consistent appreciation over the long term.

The historical comparison between the British pound and gold over the past 20 and 80 years provides compelling evidence of the pound’s decline and gold’s resilience. The recent monetary expansion and inflationary concerns underscore the importance of diversifying wealth into assets like gold that have proven to maintain purchasing power over time.

When it comes to preserving wealth, gold shines bright.

In a world where fiat currencies can lose value rapidly, gold’s time-tested role as a store of wealth remains unchallenged. So, if you’re looking for a way to safeguard your savings and maintain your purchasing power over the long term, it might be time to consider the enduring allure of precious metals like gold and silver.

Main Image by SteveBulley from Pixabay