Table of Contents

Michael Burry ‘The Big Short’ investor who predicted the 2008 housing crisis says inflation is coming.

The ‘Big Short’ investor Michael Burry, who was one of the first people to predict the subprime mortgage crisis which led to the 2008 financial crash, is now predicting hyperinflation in the U.S.

Michael James Burry is an American investor and hedge fund manager.

He was the founder of the hedge fund Scion Capital which he ran from 2000 until 2008, before closing the firm to focus on his own personal investments.

Burry is best known for being the first investor to foresee and profit from the subprime mortgage crisis that occurred between 2007 and 2010.

He shot to fame partly due the film ‘The Big Short’, a biographical drama whereby Burry is portrayed by Christian Bale. The 2015 Oscar-winning film was an adaptation of author Michael Lewis’s best-selling book of the same name.

Fans of ‘The Big Short’ will know that the story follows the work of Michael Burry (portrayed by Christian Bale) as a hedge fund manager. He is one of the first who recognises that the U.S. housing market was in a huge asset bubble which had been inflated by high-risk loans.

In 2005, Burry created a credit default swap that would allow him to short the housing market.

Burry ends up producing nearly 500% returns for investors who stay with him through the duration of the housing market’s collapse. The rest is history.

BullionStar makes it easy & seamless to buy & sell gold & silver bullion

Burry is now predicting Hyperinflation.

In a recent flurry of tweets, he is now predicting runaway inflation or even hyperinflation in the U.S. similar to that of Weimar Germany.

What is Hyperinflation?

Hyperinflation is very high and typically accelerating inflation. It quickly erodes the value of a local currency, as the prices of all goods and services increase rapidly.

Hyperinflation affected the German Papiermark, the currency of the Weimar Republic, between 1921 and 1923, primarily in 1923. It caused considerable internal political instability in the country as well as misery for the general population.

This was mainly down to excessive printing of paper money, the inability of the Weimar government to repay debts and reparations incurred from World War I, which created political problems, both domestic and foreign.

A loaf of bread in Berlin that cost around 160 Marks at the end of 1922 cost 200,000 million Marks by late 1923.

By November 1923, the US dollar was worth 4,210,500,000,000 German marks.

Excessive money printing, huge government debts and political problems, sound familiar?

Read more about inflation here.

Prepare for inflation.

In a recent tweet Burry says “Prepare for #inflation”.

He goes on to also add many quotes from ‘Dying of Money: Lessons of the Great German and American Inflations,’ a book by Jens O. Parsson.

“The US government is inviting inflation with its MMT-tinged policies. Brisk Debt/GDP, M2 increases while retail sales, PMI stage V recovery. Trillions more stimulus & re-opening to boost demand as employee and supply chain costs skyrocket. #ParadigmShift”

“The life of the inflation in its ripening stage was a paradox which had its own unmistakable characteristics. One was the great wealth, at least of those favored by the boom. Many great fortunes sprang up overnight…The cities, had an aimless and wanton youth”

“Prices in Germany were steady, and both business and the stock market were booming. The exchange rate of the mark against the dollar and other currencies actually rose for a time, and the mark was momentarily the strongest currency in the world” on inflation’s eve.

“Side by side with the wealth were the pockets of poverty. Greater numbers of people remained on the outside of the easy money, looking in but not able to enter. The crime rate soared.”

“Accounts of the time tell of a progressive demoralization which crept over the common people, compounded of their weariness with the breakneck pace, to no visible purpose, and their fears from watching their own precarious positions slip while others grew so conspicuously rich.”

“Almost any kind of business could make money. Business failures and bankruptcies became few. The boom suspended the normal processes of natural selection by which the nonessential and ineffective otherwise would have been culled out.”

“Speculation alone, while adding nothing to Germany’s wealth, became one of its largest activities. The fever to join in turning a quick mark infected nearly all classes. Everyone from the elevator operator up was playing the market.”

“The volumes of turnover in securities on the Berlin Bourse became so high that the financial industry could not keep up with the paperwork…and the Bourse was obliged to close several days a week to work off the backlog” #robinhooddown

This is a direct comparison to the recent frenzy of buying of meme stocks which has led to trading apps such as Robinhood having to temporarily halt purchases of certain stocks such as GameStop.

“All the marks that existed in the world in the summer of 1922 were not worth enough, by November of 1923, to buy a single newspaper or a tram ticket. That was the spectacular part of the collapse, but most of the real loss in money wealth had been suffered much earlier.”

“Throughout these years the structure was quietly building itself up for the blow. Germany’s #inflationcycle ran not for a year but for nine years, representing eight years of gestation and only one year of #collapse.” Written in 1974 re: 1914-1923. 2010-2021: Gestation.

Lastly he adds, “When dollars might as well be falling from the sky…management teams get creative and ultimately take more risk.. paying out debt-financed dividends to investors or investing in risky growth opportunities has beaten a frugal mentality hands down.”

So what stage of ‘The Big Short’ are we in now?

It seems like we are rapidly heading towards the later stages of the film. The insiders know that defaults are on the rise, the asset bubble is about to burst but everywhere you look people are oblivious to what is really going on until it is too late.

“I may have been early, but I’m not wrong”: Michael Burry from the film The Big Short.

You have been warned.

Since the 2008 financial crisis many have asked why didn’t Burry warn everyone about the crisis beforehand. The fact is, he did and no one listened.

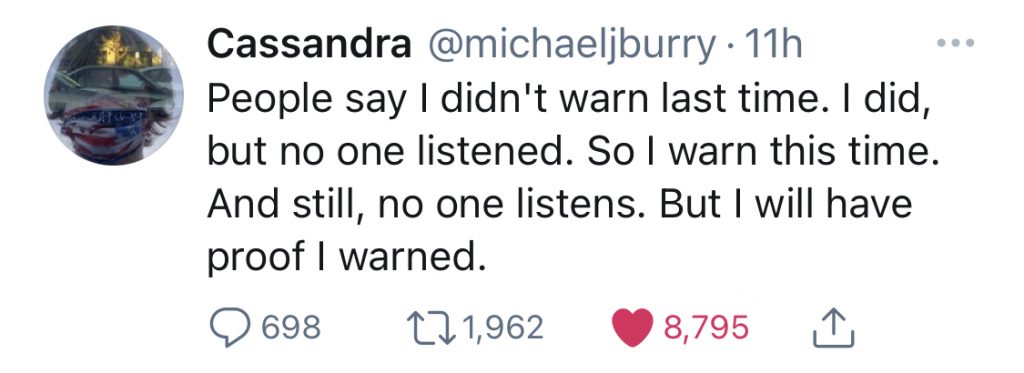

It is often the ‘geeks’, the outsiders, who are immediately dismissed, but Burry has a warning for all of us tweeting:

“People say I didn’t warn last time. I did, but no one listened. So I warn this time. And still, no one listens. But I will have proof I warned.”

Historically gold and silver have been a hedge against inflation.

BullionStar

- BullionStar: Quick & easy to open an account.

- Hassle-free & fast to place orders.

- Full online control 24/7. Buy, sell & withdraw your bullion anytime.