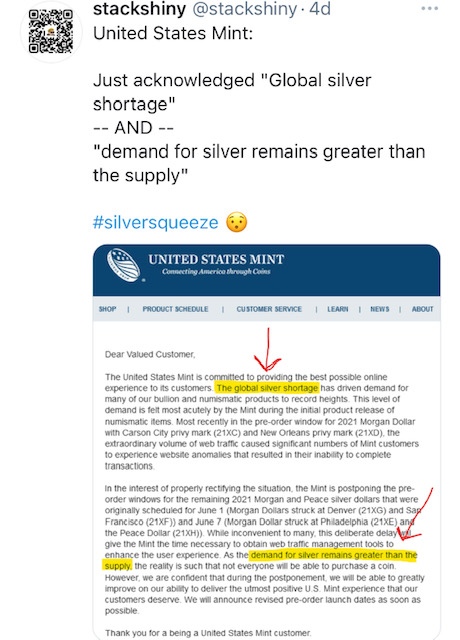

In a recent e-mail statement to customers and on a Facebook post, the US mint states that “demand for silver remains greater than the supply”, and also adds that there is a “global silver shortage”.

The e-mail and Facebook post quickly started circulating online between precious metals enthusiasts and financial analysts as it seems to confirm what many have been saying, that there is indeed a supply and demand issue when it comes to silver bullion.

Table of Contents

High demand for Silver.

Many mints across the globe including the Royal Mint have been reporting record sales of silver bullion.

Only recently, The Royal Mint has reported that the sale of silver bars has increased by 540% in March – April 2021, compared to March – April 2020.

The sales of The Royal Mint’s one-ounce silver Britannia 2021 coin also surged by over 100% during this period, with the new anti-counterfeit security features proving extremely popular with investors all over the world.

The high demand for silver is coming not only from individual financial investors but also through industrial demand as silver is used in many products such as solar panels, electric cars, batteries, glass coatings, water purification, touch screens, LED lighting etc.

Industrial buyers will simply have to pile in as the price of silver continues to go up, they will need silver to produce these green products such as electric vehicles.

The global silver shortage.

The US Mint states that “The global silver shortage has driven demand for many of our bullion and numismatic products to record heights.”

It also confirms that the mint has received an “extraordinary volume of web traffic”

This demand seems to have simply overwhelmed the US mint site which has now caused the mint to delay shipments of new products.

They continue to confirm that the, “reality is such that not everyone will be able to purchase a coin”

Physical metal.

As the silver squeeze movement continues, demand for physical silver seems to be ongoing as investors now seem more intent on having the physical metal rather than the paper equivalent such as the SLV.

This is causing many bullion dealers to set even higher premiums on the physical silver coins and bars as demand seems to be outpacing supply.

If this continues then simple supply and demand fundamentals will eventually have to kick in, which could send the spot price of silver soaring.

The much publicised Reddit phenomenon sent the silver price soaring to an eight-year peak recently as traders piled into buying shares in silver mining companies, physical silver and exchange traded funds (ETFs), in an attempt to create a GameStop style short squeeze.

The social media driven demand for silver has remained strong and sees no end in sight, with forums such as Reddit’s Wallstreetsilver boasting over 94 thousand members.

Silver.

Silver is starting to gain more and more media attention, which is now crossing over to the mainstream investor.

The ongoing #silversqueeze movement is introducing the precious metals market to a whole new mass audience.

The Reddit/GameStop story has exposed the power of the short squeeze and has turned mass media attention onto the manipulation and games played by Wall St and the big banks.

This has now spilt over to the precious metals sector with more and more people now discovering how undervalued precious metals are, especially silver.

Many in the precious metals sector have reason to believe that the paper silver market is at least 250 times the size of the physical market. Read more here.

Banks have been heavily “net short” of silver for years, this is no secret within the precious metals community.

As the US mint has now confirmed, “The global silver shortage has driven demand for many of our bullion and numismatic products to record heights”

This demand is set to continue in 2021 and beyond.

Main image by Matthew Heinrichs from Pixabay.