Table of Contents

GoldBroker Review.

GoldBroker review. Gold and Silver UK has been using the GoldBroker website for a while now, and decided look into the history and ethos of GoldBroker in more detail.

In this GoldBroker review, Gold and Silver UK goes through the site, products and services, rating and reviewing the usability, navigation, coin selection, information, price, reliability, history and more.

So, let’s start at the beginning?

What is GoldBroker?

Essentially, GoldBroker is an investment platform that allows you to own physical gold and silver in your own name and without any intermediation, stored securely outside of the banking system.

100% real gold and silver bullion.

Customers actually own 100% real physical gold and silver bars and coins and receive an ownership title in their own name. Customers also sign a contract with a vault storage partner and therefore, have direct and personal access to the secured vault to check their gold and silver holdings as and when they please.

This is good to know, because if anything were to happen to GoldBroker, your gold and silver would still be safe, as liquidators would not be able to touch your gold and silver, giving you peace of mind that your bullion is safe.

By fully owning your gold and/or silver, you are not exposed to a risk of default by GoldBroker or its partners. Therefore, GoldBroker does not own the gold or silver, you do.

Website and navigation.

The website itself has a very modern design with a nice video animation, gold and silver products and prices, as well as clear tabs across the top of the site, making site navigation very user friendly.

You are not immediately bombarded with too much information or images, which is definitely a plus.

Each tab is clearly marked, making it easy to find specific products or information, such as gold and silver bars and coins, prices, buyback options, charts, publications and more.

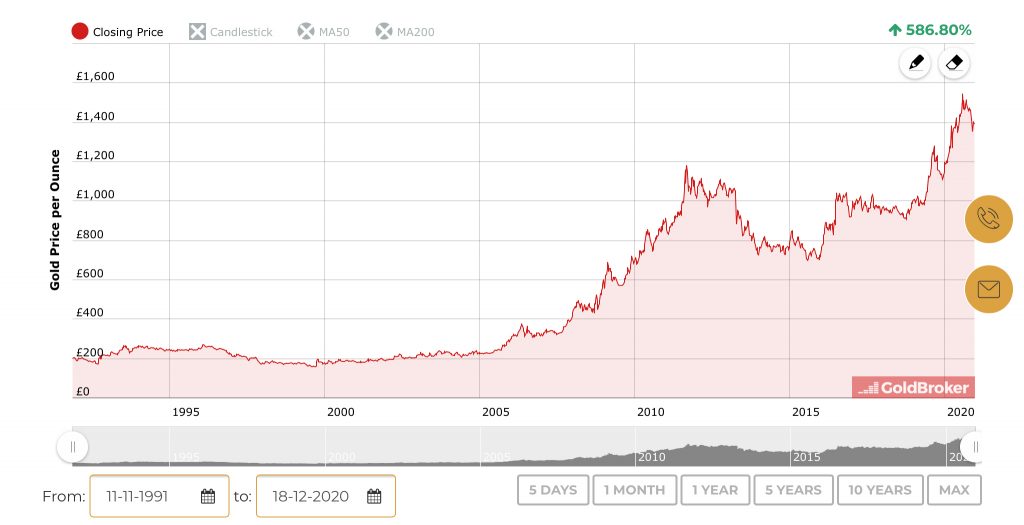

The site also features an array of gold and silver price charts which include live spot prices, historical prices, gold and silver ratio etc.

Gold and Silver UK really likes the clear design and choice of these charts which always comes in useful useful when deciding when to buy and sell your precious metals.

Although the website is predominantly bullion product focused, GoldBroker does produce some truly fantastic news articles which contain plenty of information about precious metals, the economy and the markets.

Bullion product range.

It is fair to say that GoldBroker has an excellent selection of gold and silver bullion products.

You can choose from a wide range of gold, silver, palladium or platinum bars or coins.

A simple click on either product will then take you through to the full range and prices. The prices of their precious metal products are linked directly to the current spot price and prices seem to be updated regularly.

Well known products and refineries include:

Valcambi.

Valcambi offers the highest levels of service in precious metals refining. Valcambi is one of the few gold refiners that have accreditation from the London Bullion Market Association.

Credit Suisse.

Credit Suisse was founded in 1856 by Alfred Escher to raise private funds for railroad projects. Credit Suisse has made its own brand of gold bars available to investors around the world since 1979. They are produced at the Valcambi refinery in Switzerland.

Asahi.

Asahi is an Asian company that confined its business to Japan throughout its early years. However, in 2014 they purchased Johnson Matthey and all of their refineries, including some of the most respected and productive refineries in North America. This has allowed Asahi to change direction and to focus on the bullion market, which it does by using many of the tools and standards that made Johnson Matthey one of the biggest names in the industry.

The Royal Canadian Mint.

The Royal Canadian Mint (RCM) is the (100% publicly-owned) Crown Corporation that produces all of Canada’s circulation coins. It also manufactures circulation coins for other nations. The RCM provides gold and silver assay services and runs a technically-advanced refinery.

Gold and Silver coins.

GoldBroker also provides a range of gold and silver coins from a wide selection of mints.

Gold coins.

GoldBroker offer 1oz gold coins by the U.S. Mint, the South African Mint, British Royal Mint, Royal Canadian Mint, Perth Mint and more.

Coins include some bullion classics such as gold Britannia, Buffalo, Kangaroo, Maple Leaf, American Eagle and Krugerrand.

The only catch is that gold coins are only available for purchase in rolls of 10 coins minimum.

The coins do not leave the professional storage units from the time of their fabrication and are sealed.

Their whereabouts are tracked giving you peace of mind.

Silver coins.

On offer are a selection of 1oz silver bullion coins which include coins produced by the U.S. Mint, the Austrian Mint, the Royal Canadian Mint and more.

You can choose from a range of classic silver bullion coins such as silver Britannia, Philharmonic, Kangaroo, Maple Leaf and American Eagle.

Again, there is a minimum order for silver coins, which are sold in “Monster Boxes” of 500 coins to give you the best price possible.

As these coins do not leave the professional storage units, you can pretty much guarantee they are in pristine condition, meaning your coin investment maintains its maximum resale value.

Secure vaults.

The precious metals are stored securely in private vaults outside the banking system.

The vaulted storage of the precious metals is managed by Malca-Amit, who are a private operator independent from the banking system.

Malca-Amit is a trusted storage partner for financial institutions and high net-worth individuals around the world.

Where is the gold and silver stored?

The gold and silver bars and coins are stored in secure vaults in New York, Toronto, Zurich and Singapore.

The gold and silver is fully insured and customers have direct access to the vault of their choice.

Outside of the banking system.

Having your precious metals stored in vaults outside of the banking system means you can protect your wealth from systemic risks such as counterparty default (bankruptcy), bank account confiscations (bail-ins), government confiscation, financial collapse and more.

How easy is it to buy gold and silver online with GoldBroker?

Setting up an account with GoldBroker is very simple. Gold and Silver UK set up an account in a matter of minutes.

You can set up an account using your name, address and e-mail.

To be verified, you will need to provide a copy of your passport and proof of address.

Once your account is validated, you can then continue to browse the site for your preferred precious metal products. It then works like any other online order system most people are familiar with.

Using the “cart” tab, you can select the products you wish to order and the service of your choice. Verify your order and click on “Proceed to checkout”.

You then continue to confirm your order, provide your credit card number, click on “I accept the terms and conditions”, and then click on “Place my order”.

You will then receive a confirmation message with payment instructions, together with your invoice.

Your order is then processed and the delivery of the precious metals is sent to the secured vaults of your choice in Zurich, New York, Toronto or Singapore.

Fees.

The fees/commissions do vary depending of what products you purchase and are regressive in relation to quantities ordered.

The minimum amount for an order is £10,000.

Full details of fees can be found on the website link here.

Is GoldBroker a scam?

GoldBroker is a well-established company and is definitely not a scam.

GoldBroker is operated by FDR CAPITAL LTD which in 2020, moved its operational activities to London. FDR CAPITAL LLC represents GoldBroker in the U.S.

FDR Capital Ltd is located at FDR CAPITAL LTD, Thomas House,

84 Eccleston Square, London, SW1V1PX, United Kingdom.

“Ten years of continuous development have enabled us to reach a critical size that today gives us the opportunity to establish ourselves directly in the heart of the physical gold market in London. Our company is now recognized internationally as an important player in the allocated and segregated physical gold storage business, so it was logical that we decided to move our headquarters to London”. Fabrice Drouin Ristori, Founder/CEO.

Who is the founder of GoldBroker and what is their background?

Fabrice Drouin Ristori is the Founder & CEO.

Fabrice Drouin Ristori, a 40-year old French investor and entrepreneur, is the founder and CEO of Goldbroker.com. Fabrice holds a Master degree in Entrepreneurship/Finance from the Kedge Business School (2004) and is the recipient of the 2003 Euro-Mediterranean Student Enterprise award.

Anticipating that the online gaming sector in Europe would develop, he co-founded in Malta, when he was 27 (2006), two internet marketing companies serving the online gaming sector.

Having started to invest in precious metals in 2008, he created GoldBroker in 2011, after having sold his companies.

Charts.

There is a great selection of precious metals charts on the site for customers to view.

These charts are very well designed and simple to understand for any investor.

You can simply and easily change the currency and timeframe as well as choosing the spot price.

You can choose to view Japanese “candlesticks”, 50-day moving average and 200-day moving average.

There is also a fantastic chart of the gold price annual percentage performance in all the major currencies since 2005.

Gold and Silver UK really likes this chart, as it is clear and simple for anyone to understand the sold price performance of gold over the years.

You can also see platinum and palladium prices as well as the gold/silver ratio, gold/platinum ratio and gold/palladium ratio.

As well as all this chart information, you can view the spot price in 110 different currencies of your choice.

Prices are updated every minute and data is retrieved continuously 24 hours a day, 5 days a week from the main marketplaces.

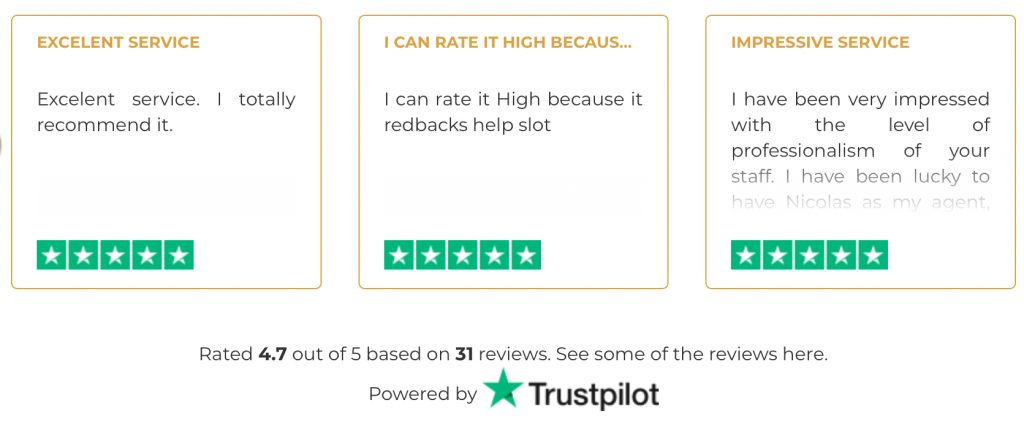

What are the customer GoldBroker reviews like?

Overall, GoldBroker has very positive customer reviews, with 94% of customers on Trustpilot rating GoldBroker as excellent.

GoldBroker definitely seems to offer a more personal customer service than some of the other dealers, and you can see this by the customer reviews.

Trustpilot gives an overall rating of 4.7 out of 5 stars, which is very good.

Precious Metals news and articles.

Although the site seems to be more product focused, it does have a truly excellent news section, which has plenty of information on precious metals, the markets, and is regularly updated with new news articles.

GoldBroker has a highly experienced team of precious metals experts, including Egon Von Greyerz and Philippe Herlin amongst others.

All the articles posted are of extremely high quality, very informative and give customers and readers real in-depth analysis of the precious metals markets and the economy, so you feel confident making your own investment decisions.

The site also has plenty of clear information about bullion and the reasons to own gold and silver. This information is great for anyone who might be new investing in bullion.

Gold and Silver UK especially likes this video they have produced, explaining why it is important to own physical gold.

https://www.youtube.com/watch?v=5z5xwb2xCyk&t=15s

Can I sell my bullion back to GoldBroker?

Yes, the site also has the option to sell your gold and silver back to GoldBroker via its ‘buyback’ service.

They can guarantee the liquidity of investments by buying back the precious metals stored in the secured vaults.

The process is very simple.

- Forward a sell order by using the secure messaging service on your account.

- Upon receiving your sell order, GoldBroker will then send you a document to be signed to order the release of the bullion products from the vaults.

- The resale price is based on the spot price at the time of the transaction, and the funds are then forwarded to your bank account via bank transfer.

Can the gold and silver be sent to my home address?

GoldBroker can deliver physical gold and silver to the United States via an insured shipping service.

They also offer international shipping to France only.

Shipping rates vary depending on the weight of the order

Unfortunately GoldBroker currently does not offer shipping of physical gold and silver products to the UK, hence the system of storing securely in private vaults.

Is GoldBroker safe to use?

GoldBroker has been specialising in precious metals investing since 2011.

GoldBroker is primarily set up as an easy and efficient way for customers to buy and sell allocated gold and silver bullion via a vaulting facility.

The gold you own in the vault is in your name and insured in case of loss or damage.

This saves you from the potential hassle related to storing and shipping of precious metals.

GoldBroker uses the very latest technology and security systems to ensure the site is secure and safe.

The physical gold and silver that is purchased remain in the vault where they are stored after purchase.

This gives you maximum security of your precious metals.

The vaults’ security and safety systems incorporate a uniquely tailored mix of physical surveillance, cutting-edge technology, 24/7 monitored CCTV, and alarm, climate, and fire control systems.

Is the gold and silver insured?

GoldBroker ensures that the gold and silver bars and coins are properly and adequately insured against theft and damage, in accordance with the insurance standards accepted by the physical precious metals industry.

The GoldBroker App review.

Gold and Silver UK especially likes their free app which is very user friendly, and the quick charts feature is very useful for checking spot prices on the go.

It is easy to browse products, check your stock, read the latest news articles and message direct straight from the app.

The app is a great addition, Gold and Silver UK uses the app regularly and has never had any issues with it.

What does the LBMA mean?

With GoldBroker, you can purchase gold bars produced by recognized refiners, certified by the LBMA which stands for the London Bullion Market Association.

Gold or silver bullion bars that are “LBMA Certified” means that these claims can only be specifically made by bullion refineries that meet a specific high standard.

Stringent criteria are put in place and are regularly monitored by the LBMA, it produces a standard that is trusted around the world also known as, ’Good Delivery’.

You can read more about the LBMA here.

Why should I buy gold and silver?

There are many reasons to buy gold and silver.

You can read more about some of the benefits of owning gold and silver here:

Are there any negatives to using GoldBroker?

Buying small quantities of coins for example, could be an issue as the minim order is £10K and coins come in rolls of 10.

Storage fees for the precious metals are on a sliding scale not a flat rate per year, so be aware of any storage fees in advance.

Currently they do not ship the physical metals for the UK, although this is not really essential for many investors, some might want a few coins in their own possession.

You can, however, visit either one of the secure vaults upon request.

What is the difference between an ETF (Exchanged-traded funds) and direct ownership?

ETFs (Exchanged-traded funds) are investment funds trading on stock market exchanges just like stocks. These funds reproduce the performance of assets, stocks (stock indices), currencies, commodities or bonds. They trade near the value of their underlying assets.

ETFs are essentially designed to track the gold price using complex derivatives.

GoldBroker is different as it offers direct gold and silver ownership, with no intermediation, and storage outside of the banking system, meaning the gold and silver bullion is yours.

Conclusion of GoldBroker review.

Overall an excellent website, well-structured with plenty of bullion products available.

GoldBroker offers excellent customer service and seem happy to guide new customers through the sometimes daunting process of investing in precious metals.

The website is also packed with informative articles and essential reading for all precious metal enthusiasts.

Prices are competitive and each product is clearly listed and priced, making it an easy to choose products and add to your basket.

The great service, product range, information and efficiency of the site makes GoldBroker an excellent choice for any precious metals investor.

Hope you enjoyed this GoldBroker review?

Disclaimer:

Gold and Silver UK is an account holder and affiliate of GoldBroker which may provide us a commission at no extra cost to you. The articles or blog posts on this website are for general information/opinion purposes only and does not constitute either goldandsilveruk.co.uk or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the articles without first seeking independent professional advice. Care has been taken to ensure that the information in the articles are reliable; however, goldandsilveruk.co.uk does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such.

The site goldandsilveruk.co.uk will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in these articles or blog posts and any action taken as a result of the opinions and information contained in these articles or blog posts is at your own risk. All rights reserved www.goldandsilveruk.co.uk

This website/blog may generate revenue through paid sponsorships, advertising, paid insertions and affiliate partnerships.

goldandsilveruk is a precious metals enthusiast who wants to give authentic, clear, simple, transparent information and opinion to readers. Compensation may influence advertising content, topics or posts made on the blog. However, all paid and/or sponsored content and advertising space and posts would be identified.

All facts and claims made in posts should be independently verified with the manufacturer or provider. If a conflict of interest exists in the content, it may not always be identified.

Changes made to the policy will be identified on disclaimer page and in the general privacy policy and T&C.

GoldBroker UK Review

GoldBroker Review

Essentially, GoldBroker is an investment platform that allows you to own physical gold and silver in your own name and without any intermediation, stored securely outside of the banking system.

Customers actually own 100% real physical gold and silver bars and coins and receive an ownership title in their own name. Customers also sign a contract with a vault storage partner and therefore, have direct and personal access to the secured vault to check their gold and silver holdings as and when they please.

The website itself has a very modern design with a nice video animation, gold and silver products and prices, as well as clear tabs across the top of the site, making site navigation very user friendly.

Pros

It is fair to say that GoldBroker has an excellent selection of gold and silver bullion products.

You can choose from a wide range of gold, silver, palladium or platinum bars or coins.

GoldBroker offers excellent customer service and seem happy to guide new customers through the sometimes daunting process of investing in precious metals.

Prices are competitive and each product is clearly listed and priced, making it an easy to choose products and add to your basket.

Cons

Buying small quantities of coins for example, could be an issue as the minim order is £10K and coins come in rolls of 10.

Currently they do not ship the physical metals for the UK, although this is not really essential for many investors, some might want a few coins in their own possession.

You can, however, visit either one of the secure vaults upon request.