Table of Contents

How to understand UK gold and silver prices

The prices you pay for gold and silver in the UK can vary dramatically.

The current price of gold and silver is most often called the spot price.

So what is the Gold and Silver Spot Price?

Spot price (which is also sometimes called the market price, or the live price) is the current price for gold and silver, but this price is continuously changing.

It is essentially the current market price for that particular precious metal which is traded in the wholesale market for immediate delivery.

This spot price is determined by supply and demand dynamics on the market at that time, which is why it is constantly changing, it is ultimately an indicator of initial value, and is not necessarily the price most private investors will pay.

The spot price is more often than not quoted in U.S. dollars per troy ounce and refers to a quotation for a standard but large quantity of the precious metal.

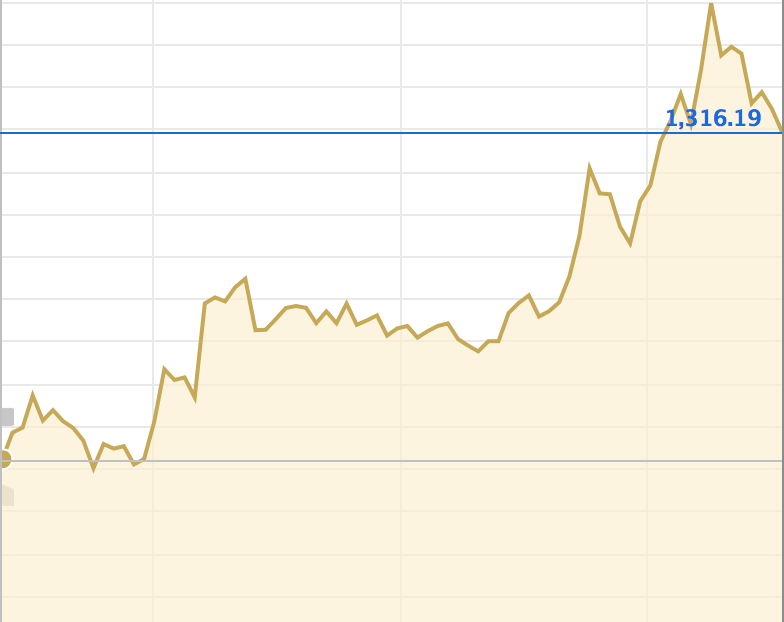

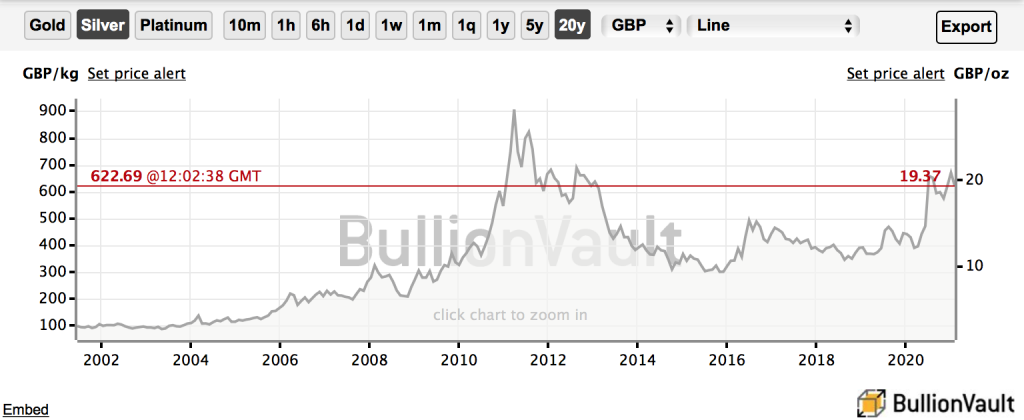

On most spot price charts you can change the currency and timeframe so you can see how the price is fluctuating over time in your own currency.

Check the current UK gold spot price by clicking on the chart below.

Check the current UK silver spot price by clicking on the chart below.

BullionVault’s gold and silver price chart, for example, takes data from multiple sources covering hundreds of dealers worldwide. It also shows you the average mid-point of their spot quotes to buy or to sell gold and silver.

Gold and Silver are traded around the world.

Gold and Silver are traded around the world during the week.

There will always be a live and changing spot price that feeds in from around the world wherever trading activity is highest.

Why is the price of gold and silver higher than the spot price when I buy it from a dealer?

Spot prices are price quotations for trading large standard quantities of a precious metal in the wholesale market, not individual bullion bars or bullion coins.

With this in mind private investors who buy gold and silver from a precious metals dealer pay the spot price plus a premium.

Not many people actually get to buy gold and silver at spot price. Individual smaller investors will always have to pay slightly above the spot price to cover additional costs, such as the actual time and labour which has been used to make a specific coin or bar.

There are also delivery costs which included those costs from refiners to dealers. As well as taking into account things like marketing, dealers running costs, secure storage, insurance, bespoke packaging, administration fees, tax and more.

This is why there can sometimes be a large disconnect between the spot price and the price you might pay at your local precious metals dealer.

Keeping premiums low.

Private investors can access the gold and silver market direct, buying and selling at the UK gold/silver benchmark through sites such as BullionVault, or trade live at current spot gold prices.

The futures price.

The spot price is separate from the futures price.

A futures price is an agreed price for an asset such as gold or silver for delivery in the future, to be paid at an agreed future date; locking in the current price and, therefore, ignoring what the spot price will be on that future date.

These spot and future prices can be correlated. If there is currently high demand this could increases the spot price, buyers may then go into the futures market, this could then reduce spot price due to the increased demand for futures.

The London Fix or LBMA Gold price.

The London Fix or LBMA Gold price, is a daily UK gold alternative to the spot price.

It offers a single UK gold value twice a day. It is an agreement between participants on the same side in a market to buy or sell precious metals at a fixed price, or to maintain market conditions such that the price stays at a given level by controlling supply and demand.

Orders are changed throughout, as the price is moved higher and lower until such time as the orders are satisfied and the price is said to be “fixed”.

It is similar to the spot price, but the LBMA Gold price helps prevent any sudden movements that could negatively impact either side in a large transaction.

What is the LBMA? Read more here.

The LBMA, London Fixed Price in the UK is published weekdays at 11am and 3pm for gold and midday for silver.

This fix price can be seen as somewhat of a middle ground between the spot price and the futures price. This helps those placing large orders of precious metals to remain confident of a good price in the event of price fluctuations.

Conclusion.

Either way, both gold and silver are highly liquid and you will always have someone willing to buy your gold or silver as both precious metals are always in demand.

It’s free to open an account with BullionVault and registration takes less than a minute. There’s no obligation to trade.