In this beginner’s guide to gold and silver in the UK you will learn the basics about bullion, fiat currency, investment options, coins or bars, popular gold and silver coins and more.

Table of Contents

A Beginner’s Guide to Gold and Silver. UK.

One of the first things any new investor would need to understand, is that gold and silver are the purest and most basic form of money.

Gold and silver have been used as a medium of exchange and a reliable store of value for thousands of years.

It is only in relatively modern times (1971 to be exact, when president Richard Nixon essentially took the dollar off the gold standard) that the world has transitioned into fully fiat currency system (eg British pound, euro, U.S. dollar) that is not backed by gold. Before 1971 all fiat currency (paper money) was backed up by gold.

Debasement of fiat currency.

In simple terms fiat currencies (British pound, euro, U.S. dollar etc.), are being printed (or typed into existence on a computer ledger) at an astonishing rate by central banks, which is essentially eroding the value of each and every fiat currency.

Fiat currencies can basically be created out of thin air, therefore, governments and central banks can’t help themselves and always resort to printing more money (fiat currency), especially in times of crises. If you look back through history, then inevitably the value of fiat currency declines, therefore, the price of gold denominated in fiat currency usually goes up.

“Paper money eventually returns to its intrinsic value — zero.” ~ Voltaire

So why do people buy gold and silver?

Gold and silver are benefiting from this current financial environment.

Because many currencies are continuing to be printed in the form of quantitative easing, this is making many savvy investors seek out safe havens to store their wealth which is often gold and silver.

This is causing gold and silver, which is true money, to go up in value over time. People are essentially investing in gold and silver to preserve their purchasing power.

Many investors understand that gold and silver will always have value, especially in times of economic uncertainty.

Why is the price of gold hitting record highs?

Recently, the spot price of gold in US dollar terms set a new record of $2000 per ounce (August 2020), the highest recorded gold spot price in history.

Gold has surged by over 30% since the beginning of 2020.

Silver has also had an excellent year so far. Silver’s price gains are almost double that of gold. This is largely due to geopolitical tensions, falling real rates and a weak dollar.

Gold and silver, but especially gold, is seen as a hedge against economic downturn.

The U.S. dollar is the World’s reserve currency, and it seems that the U.S. dollar is starting to lose its appeal among investors. This is all adding to the uncertain future of the U.S. dollar, and that makes many investors want to run to the safety of gold.

The continued injection of large quantities of cash, especially in U.S. dollars, is essentially making those dollars less valuable.

The same can be said in the UK, with the UK national debt now over £2 Trillion (Source www.nationaldebtclock.co.uk).

Although many citizens have benefitted from these stimulus packages in the short term, the long term consequences are potentially more harmful financially to the average person.

Whichever way you look at it, the value of fiat currency is slowly eroding as the supply is being increased.

Gold and Silver retain their value.

Gold and silver cannot simply be printed. Gold and silver require vast amounts of work via exploration, mining, transportation, refining & minting. This limits the increase in supply.

Central banks on the other hand can simply increase the supply of currency by adding a few more 0’s.

This is a key reason why gold and silver are seen as a hedge against a failing economy, which is very relevant in 2022.

Many investors look to the safe haven of gold and silver before markets and potentially the financial system start to collapse.

Has gold and silver gone up in price? Or has gold and silver simply remained at the same value while the value of U.S. dollar, British Pound, Euro and others is falling?

Gold and silver investment options.

Commodity ETF’s. Gold and silver Exchange-traded funds are convenient and liquid.

However does not give you access to the physical gold and silver. You would not get a delivery of a gold bar or coin.

Common stocks and mutual funds. Shares of gold and silver miners, leveraged to price movements.

Futures and options. Derivatives.

Bullion. Coins and Bars.

Certificates. Offer gold and silver ownership without transportation or storage hassle.

However, in a crisis situation they are just paper certificates.

What is bullion?

A classic term for bullion is basically gold and silver (and other precious metals) in the form of bullion bars, ingots and bullion coins.

Gold bullion is usually used for investment purposes, and is based on its purity level such as 24-carat gold, .9999 fine or 99.99% pure gold.

100% pure gold bullion is basically impossible to refine, so bullion gold and silver refiners use 99.99% pure gold bullion for general production. For example, the gold Canadian maple leaf coin or gold British Britannia coins are .9999 fine gold, however, anything over .995 fine (99.5% pure gold) is considered good for investment purposes.

Modern silver bullion coins and bars usually have purity of 99.9% (.999 fine).

So what should I choose? Gold or Silver?

Gold will always be the ultimate core investment if you are choosing between gold or silver. Gold is often seen as a more stable investment.

Gold is more likely to be hoarded and stored away in vaults for very long periods of time making it harder to come by in its physical form.

Silver is also used as a store of value but also has many industrial uses.

In the UK silver has a particularly low purchasing price compared to gold and the gold to silver ratio is still relatively very high at the moment making silver a good option to diversify your investment portfolio and could have more gains in the future.

You can read more about the advantages of owning gold and silver in the links below:

Our top reasons to own Silver.

What do I do about TAX and VAT?

Bullion is subject to UK capital gains tax. However, some specific coins such as British Sovereign or British Britannia are exempt from capital gains tax as they are technically British legal tender.

In the UK gold is exempt from VAT, but silver is subject to VAT at the standard rate.

You can read more about the Tax implications of gold and silver here.

Coins or bars?

Gold and silver coins are ideal for both small and large investors.

Gold and silver coins allow flexibility as you can buy small amounts over time to build wealth gradually.

For larger investors coins such as Britannia coins and British Sovereign coins are especially popular due to being Capital Gains Tax (CGT) exempt.

Gold and silver bars do have the advantage of economies of scale, whereby the premium paid over spot price could be reduced the bigger the gold/silver bar.

Bars can be harder to sell as it would be easier to sell say, half your 1oz coin collection, than it would to sell half your 1kg gold or silver bar.

What are the most common bullion coins?

Some of the most common coins might be:

1oz Gold/Silver Britannia.

A Britannia has the luxury of being Capital Gains Tax exempt in the UK and is a very cost effective way to invest in tax free gold coins.

Gold Sovereign.

One of the most recognisable gold coins in the world. Small in size makes them easy to store. Sovereigns are a good way to start investing in gold at an entry level, due to them being more affordable at today’s prices. These 22-carat coins are also exempt from Capital Gains Tax in the UK.

American Eagle.

America’s most popular and preferred bullion coin. A global icon.

Canadian Maple.

The official bullion coin of Canada. The 1oz Gold Maple has a striking Maple Leaf design, attracting collectors as well as investors.

Chinese Panda.

The Chinese Panda bullion coin has the unique feature of a portrait of a giant panda that is re-designed every year.

South African Krugerrand.

The world’s first ounce denominated gold coin.

Read our top 5 gold bullion coins for UK investors here.

Read out top 5 silver bullion coins for UK investors here.

Where should I store my gold and silver?

Storing gold and silver at home.

Storing gold and silver in your house is an option. However, it is probably best to install a high quality safe, tell your insurance company and, most of all, keep this information to yourself. Don’t go telling anyone on Facebook or your mates in the local bar.

When it comes to storing gold at home, only you and possibly very close family members, should know that you store gold at home.

Some gold and silver investors even install a dummy safe as a decoy if there was to be an unfortunate break in at your property.

Make sure there are a few layers of protection. Most potential thieves would want a quick grab-and-go situation.

Therefore, it could be an option to have a safe under floor boards with carpet over the top, or behind a cabinet within a wall.

Private secure vaults.

There are a large number of online bullion dealers that will offer you the option of holding your gold and silver in secure vaults that can be bought or sold in whatever quantity you want, whenever you want.

Having your gold and silver bullion in a private secure vault (using an established and trusted provider), offers ultimate peace of mind to any precious metals investor, as well as having some degree of flexibility when it comes to selling your gold and silver.

Safety deposit box.

There are also things like putting your gold and silver in a safety deposit box. However, expect annual charges and make sure you do your research and use trusted branches.

With a safety deposit box, it is secure to a degree.

However technically, a safety deposit box could be seized, or the law could change, whereby your access is denied.

A safety deposit box is an option to store gold and silver in a small secure space for a relatively small fee, which could actually work out cheaper than the extra home insurance premium.

How much is a gold or silver coin worth in the UK?

As explained earlier, the spot price of bullion gold and silver will determine the overall price of a gold or silver coin. Gold will always be of much higher value than silver as gold is more scarce, and investors usually see gold as the ultimate safe haven asset before considering silver.

There are also different sizes, years, styles and weights of gold and silver coins, from a 1/10th ounce Britannia, to a gold sovereign and more. Some coins also have numismatic value as they are rarer or are seen as collectors’ coins.

Either way, bullion coins can be a great investment for the future. Always check the spot price and always buy gold and silver coins from a well-established local or online dealer.

Most online dealers have the prices of all the different coins on their website, and most prices are updated daily along with the spot price.

Is gold a good investment in the UK?

First and foremost, gold is not an income producing investment like other assets such as equities, bonds or property that you would normally find in a standard investment portfolio.

With gold investors, it is all about the price of gold going up or down and how this fits in to your overall investment portfolio. Investors would normally use gold to help diversify and to add a so called insurance policy when investment in areas such as the stock market are failing.

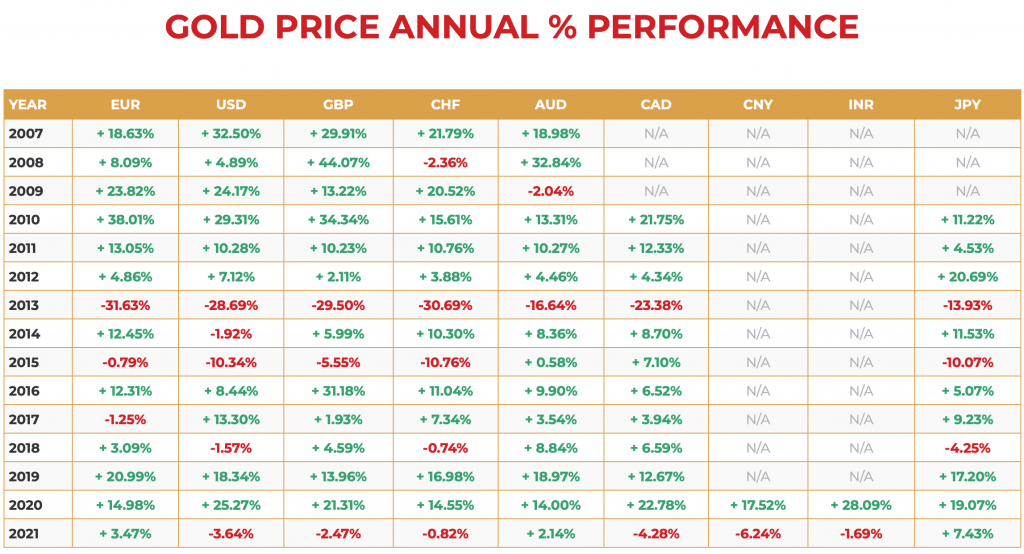

In recent years in the UK, it is reasonable to say that gold has had a good run, seeing gold prices continue to rise hitting new highs. See gold prices chart link on this website for info.

Typically, the price of gold usually does well in times of uncertainty, whether that be financial instability, political instability or global disasters.

Are many of these things happening in 2022?

Is gold a good investment during a recession?

To many investors gold is usually seen as a safe-haven asset. Historically, especially during a recession, investors have rushed into gold as a way to spread risk and to diversify their investment portfolio when other investments such as equities are falling.

Throughout history, the price of gold has usually done well in times of economic turmoil, geopolitical uncertainty and during recessions.

The reason for this is typically, the stock market will fall during a recession as companies make less profit. Investors then see gold as a safe-haven asset, as gold does not derive its value from a business or credit. Gold is valuable in itself.

Obviously there have been ups and downs in the price of gold. However, you would see gold investment increase in value naturally over time as pound sterling fiat currency continues to devalue.

You can read more about gold during a recession here.

What should I be aware of?

Like in any industry, be aware of gold/silver scams, fake coins, cold callers, e-mail or marketing scams. It is always best to use well established, trusted bullion dealers.

e-bay?

The only thing to say here is, do you trust the seller and can you be sure that the bullion is genuine?

If you can buy gold and silver below spot on e-bay, then it’s probably too good to be true.

Be compliant with laws.

As a new investor you can buy small denominations anonymously if you wish, you don’t necessarily have to identify yourself or disclose personal information.

However, if you are lucky enough to be in a position to make large purchases of gold and silver, make sure that you follow the law and that it is declared in the proper manner.

Why should I invest in precious metals?

Gold and Silver is a great way to diversify your investment portfolio, as it offers a unique chance to store your wealth outside of the banking system.

Physical gold and silver has been a strong and reliable store of value for centuries.

The price of gold and silver will never go to zero like a-lot of paper assets. Gold and silver coins for example, are an ideal alternative to printed fiat currency.

Where to buy gold and silver bullion online?

Buying precious metals online can be a daunting prospect. You want to ensure you are getting the best deal as well as ensuring reliability and quality of service.

Gold and Silver UK will guide you through the minefield of online bullion dealers, filtering out noise and focusing on providing only the best, most trusted and reliable websites to buy gold and silver bullion.

BullionStar

BullionStar is a popular online gold and silver bullion dealer. They offer worldwide shipping as well as a vault storage service which is a great solution for buying, selling and storing bullion.

BullionVault

4 Grams of FREE Silver on Sign up! VISIT BullionVault

BullionVault lets private investors around the world access the professional bullion markets. You can benefit from the lowest costs for buying, selling and storing gold and silver.

GoldBroker

Buy physical gold and silver (high-quality bullion bars and coins) in secure storage, outside the banking system with GoldBroker.

Disclaimer: The articles or blog posts on this website are for general information/opinion purposes only and does not constitute either goldandsilveruk.co.uk or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the articles without first seeking independent professional advice. Care has been taken to ensure that the information in the articles are reliable; however, goldandsilveruk.co.uk does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such.

The site goldandsilveruk.co.uk will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in these articles or blog posts and any action taken as a result of the opinions and information contained in these articles or blog posts is at your own risk. All rights reserved www.goldandsilveruk.co.uk

This website/blog may generate revenue through paid sponsorships, advertising, paid insertions and affiliate partnerships.

goldandsilveruk is a precious metals enthusiast who wants to give authentic, clear, simple, transparent information and opinion to readers. Compensation may influence advertising content, topics or posts made on the blog. However, all paid and/or sponsored content and advertising space and posts would be identified.

All facts and claims made in posts should be independently verified with the manufacturer or provider. If a conflict of interest exists in the content, it may not always be identified.

Changes made to the policy will be identified on disclaimer page and in the general privacy policy and T&C.