Table of Contents

Gold is money.

Throughout history, money has been in the form of various objects such as shells, silk, paper and obviously precious metals such as gold and silver.

Money simply allows people to trade goods and services with one another, and money can be used as a tool to communicate the price of these goods and services.

Money also provides a way for people to store their wealth over long periods of time.

Technically, money can be anything, but to perform as reliable money, it must do the following things:

1 It has to be a store of value and maintain its purchasing power over long periods of time.

2 It has to be a medium of exchange.

3 It has to be a unit of account. The pound sterling is a unit of account for example, as it has numbers on it.

4 It must be durable.

5 It must be portable so you can transfer the value easily.

6 It has to be capable of being divided (divisible), have the ability to give change.

7 It has to be something that can be replaced by another equal part or quantity in paying a debt or settling an account (fungible).

Fiat Currencies for example, are widely considered as ‘money’, but over time many Fiat Currencies have come and gone, mainly due to debasement of those currencies by governments.

For thousands of years gold has always maintained its purchasing power.

Gold is real money and gold will always have value. Gold is money in its most basic and purest form.

To understands this, let’s have a brief look back through history to understand why gold is the ultimate form of real money.

Gold and silver.

BullionVault lets private investors around the world access the professional bullion markets. You can benefit from the lowest costs for buying, selling and storing gold and silver.

4 Grams of FREE Silver on Sign up! VISIT BullionVault

We are going to start in ancient Egypt, where gold became the chosen form of money due to its unique properties, amongst other things, of being durable and of limited supply.

This eventually progressed to creating coins, whereby kings and governments would take overall control of a country‘s currency.

The coins were usually made out of the most suitable hard commodities which of course were gold and silver.

However, time and time again kings and governments tried to debase the currency by adding cheaper metals, this always led to economic disaster.

Gold and silver naturally became the predominant metals of choice for sound money.

Sound money is money that is not liable to sudden appreciation or depreciation in value.

Banks and paper currency.

Banks were created as safe vaults to help people store their precious commodities such as gold and silver.

Paper currency eventually started to emerge around 3000 years ago in China, where paper became the chosen form of receipt (ie paper money) which was convertible to a set amount of gold.

Whenever someone deposited their gold into a bank, the bank would then issue that person with a paper receipt for the amount of gold they had stored in the banks vaults.

As time went by, these paper receipts were obviously perceived as being as good as gold itself, therefore people started to trade these paper receipts as everyone believed they were the equivalent of gold.

As a consequence they were naturally used to buy goods and services.

These paper receipts were seen as a more convenient way to trade in gold without having to move the physical gold between various banks or vaults.

As more and more of these paper receipts started trading, banks started simply issuing more and more paper receipts.

However, these receipts were actually backed by gold they simply didn’t have, they were in fact backed by nothing. They would actually lend these receipts to borrowers.

The banks were essentially creating new paper money that was supposedly backed by gold, but they did not have enough gold in their bank vaults.

People started to realise that something wasn’t quite right and this eventually led to bank runs and banks going bust because too many people were trying to claim gold they thought they had, but the gold simply did not exist.

Central Banks.

Governments decided to get involved as they wanted to try to prevent these kinds of bank runs and financial pressures. This is when central banks were created as a way to try and bring more overall stability to the banking system.

A Central bank, reserve bank, or monetary authority, is an institution that manages the currency and monetary policy of a state or formal monetary union, and oversees their commercial banking system.

Central banks became the lender to governments and would also become the lenders of last resort to the banks.

Central banks hold a number of assets such as currencies, government debt and gold, as a way to give some kind of confidence in the banking system.

However, eventually, over time laws were passed so that commercial banks could create more money than they had in deposit through various regulations and legal changes.

The Federal Reserve (Fed).

The Federal reserve, known as ‘the Fed’, was created on December 23, 1913 and it was basically granted the power to create paper money (federal reserve notes). President Woodrow Wilson signed the Federal Reserve Act into law.

Federal reserve notes had to be backed by gold and ended up with a 40% gold backing.

During this time there was excessive borrowing for stock-market speculation in the U.S. as people placed high risk stock-market bets. Eventually the stock market crashed.

This led to the great depression of the 1930s. The Great Depression was the worst economic downturn in U.S. history.

It began in 1929 and did not abate until the end of the 1930s. The stock market crash of October 1929 marked the beginning of the Great Depression.

By 1933, unemployment was at 25 percent and in excess of 5,000 banks had gone bust.

Because Federal reserve notes were 40% backed by gold, the government was not able to ‘recover’ the economy by simply printing more federal reserve notes into existence.

Because of the major financial crash, naturally people were worried about their own personal finances and the general public simply stopped spending.

They would use their gold savings as a way to protect their wealth during this time of financial uncertainty.

Essentially, people were not spending or borrowing money, this was a problem, as the economy was stalling.

Astonishingly, in 1933 President Roosevelt made gold ownership illegal.

All U.S. citizens were ordered to take their gold to the nearest bank in exchange for $20.67 in Federal reserve notes.

At the time, the public did not fully understand that they were trading in their real money, gold.

Today gold is worth around $1900 oz, and the purchasing power of the federal reserve notes has dropped over 95% in that time period.

In short, the Federal reserve did extremely well in this trade, whereas the average U.S. citizens was essentially given a very bad deal, as their real wealth (gold) had been taken away and replaced with now next to worthless paper.

The Breton Woods Agreement.

In July 1944, 730 delegates from all 44 Allied nations gathered at the Mount Washington Hotel in Bretton Woods New Hampshire, United States, for the United Nations Monetary and Financial Conference, also known as the Bretton Woods Conference.

The United States, which controlled two thirds of the world’s gold, insisted that the Bretton Woods system rest on both gold and the U.S. dollar.

Essentially, countries could settle their international accounts in dollars. Those dollars could be exchanged into gold at an exchange rate of $35 dollars per ounce redeemable by the U.S. government.

The U.S. was committed to backing every dollar with gold, and all other currencies around the world were pegged to the dollar.

Other currencies around the world pegged their value to the US dollar at a fixed rate.

As the US dollar was then seen as good as gold itself, then other currencies around the world agreed to peg their value to the dollar thinking that the dollar was the equivalent of gold.

Gold was somewhat of a regulator on international trade and currency valuations.

Going digital.

Eventually over time, U.S. private banks were given the authority to create new digital dollars, backed by the country’s debt every time they decided to issue a new loan.

As we entered a more digital world, so did money as it became digitised. This digital money that was created by banks, backed by debt, simply started to balloon out of control.

Banks could now essentially create as much money as they wanted, as debt and central banks had policies in place to try and keep this whole financial system working.

However, this new type of central banking system created huge boom and bust cycles.

Through various laws and regulations, banks would eventually become the legal owners of all bank deposits held at their bank.

This means that whenever you deposit your hard earned money into a bank, that money is no longer yours. The bank legally owns that money and can do whatever it likes with it. You essentially become a liability to the bank as they owe you that money, which brings up all sorts of issues.

This money can be used by banks as collateral to issue further loans, and they can simply benefit from this by charging interest on this newly created digital money.

Banks can essentially create brand new money every time they decide to issue a new loan.

If you apply for a mortgage for example, there is no money in existence before you apply for that mortgage. You basically create that money for the bank by promising to pay that money plus interest via your work, time and skills into the future.

Going back to gold.

BullionVault is the world’s largest online investment gold service taking care of $3 billion for more than 85,000 users.

4 Grams of FREE Silver on Sign up! VISIT BullionVault

Eventually, countries around the world began to realise that there was more dollars than gold in existence, so they started to trade in their dollars for real money, gold.

The U.S. started to panic as it was losing vast amounts of its gold reserves to these other countries, so in 1971 president Nixon ended the Breton woods system.

Now the dollar was no longer backed by gold at all.

The dollar was now a debt backed standard. As all major currencies across the globe were pegged to the dollar, then essentially all currencies became fully fiat currencies backed by nothing but debt.

Today’s monetary world.

In today’s world, every time you check your online bank account, that money has simply been created by a bank every time someone else agrees to borrow it into existence via a loan.

If you were to fail to repay that loan then the bank can take your real assets, such as your home or other assets.

Because of all this debt and easy money, those who know how to play this debt system can become increasingly more wealthy, as we can see with the wealth inequality in our society today.

As this financial system becomes more and more complicated through thousands upon thousands of financial products and derivatives, people have understandably become more detached from money and how to manage their own money.

People can easily lose sight of what is real money and can get bogged down in easy credit.

People now simply seem to hand over their money to the same people who are creating more and more financial complexity, which is leading to more dramatic booms, busts and financial crises.

Because president Nixon removed the final remains of the gold standard in 1971, this has created the biggest debt bubble in history as consumers take on more and more debt such as mortgage, car, student, store and credit card debt.

Although the vast majority of people don’t know it yet, 1971 will become a pivotal moment monetary history.

Corporations have also created more debt by selling more and more corporate bonds.

Instead of doing the right thing and re-investing that money into the company to improve the quality of the products, services or systems, many of these large companies have been using that money to buy their own stocks (Stock buybacks refer to the repurchasing of shares of stock by the company that issued them) and therefore push up the stock price.

As governments have got even bigger, then national debts have also grown to epic levels as they spend more to try and spur on economic growth, as well as promising more free ‘stuff’ to their citizens via MMT (modern monetary theory) and other controversial policies.

The banks are now too big to fail. They can create money via new loans, and if you do not pay back the loan, then they get to keep your real world assets.

If the banks make too many bad loans and get into financial trouble, then history seems to show that they can simply request that the tax payers bail them out once again.

They also have the option of Bank Bail-Ins, where they take your deposits to create liquidity for the bank.

Read more about Bank Bail-Ins here.

In 2008 during the financial crisis, Central banks introduced Quantitative Easing, whereby they printed vast amounts of new money to fend off a major collapse in the financial system. QE is still happening today.

Because there is no longer any link to gold, only debt, QE is a way for governments to borrow an unlimited supply of money through the Central banks, who create this money out of thin air.

Global debt.

Global debt is now spiralling out of control.

In 2020 the Federal Reserve announced ‘unlimited QE’.

Recently the International Monetary Fund released a short video asking world leaders for a ‘New Bretton Woods’ style agreement.

It is obvious that global debt is now unsustainable and a re-negotiation of the monetary system is needed.

There has been much talk about Central Bank Digital Currencies, whereby citizens could be issued a digital wallet on their phone and money could be issued directly from Central banks to citizens.

This brings up a whole host of moral issues.

Digital currency is programmable, it can be used in many ways to restrict payments, automatically take taxes, it can be tracked, it could be used to introduce negative interest rates and more.

Essentially, it no longer gives you freedom to spend or save your money anonymously.

You can read more about this ‘New Bretton Woods’ and Central Bank Digital Currency here.

Gold has always been the consistent form of money throughout history for literally thousands of years. An ounce of gold is still an ounce of gold and it still has high value today.

Kings, queens, governments, banks, central banks, economists have all tried to cheat gold, but at the end of the day, gold always wins.

History shows time and time again that gold has been the key part of any new monetary re-negotiation.

Gold is a Tier 1 asset.

Tier 1 is regarded as the most valued and conservative type of capital.

Central banks see tremendous value in holding physical gold bullion.

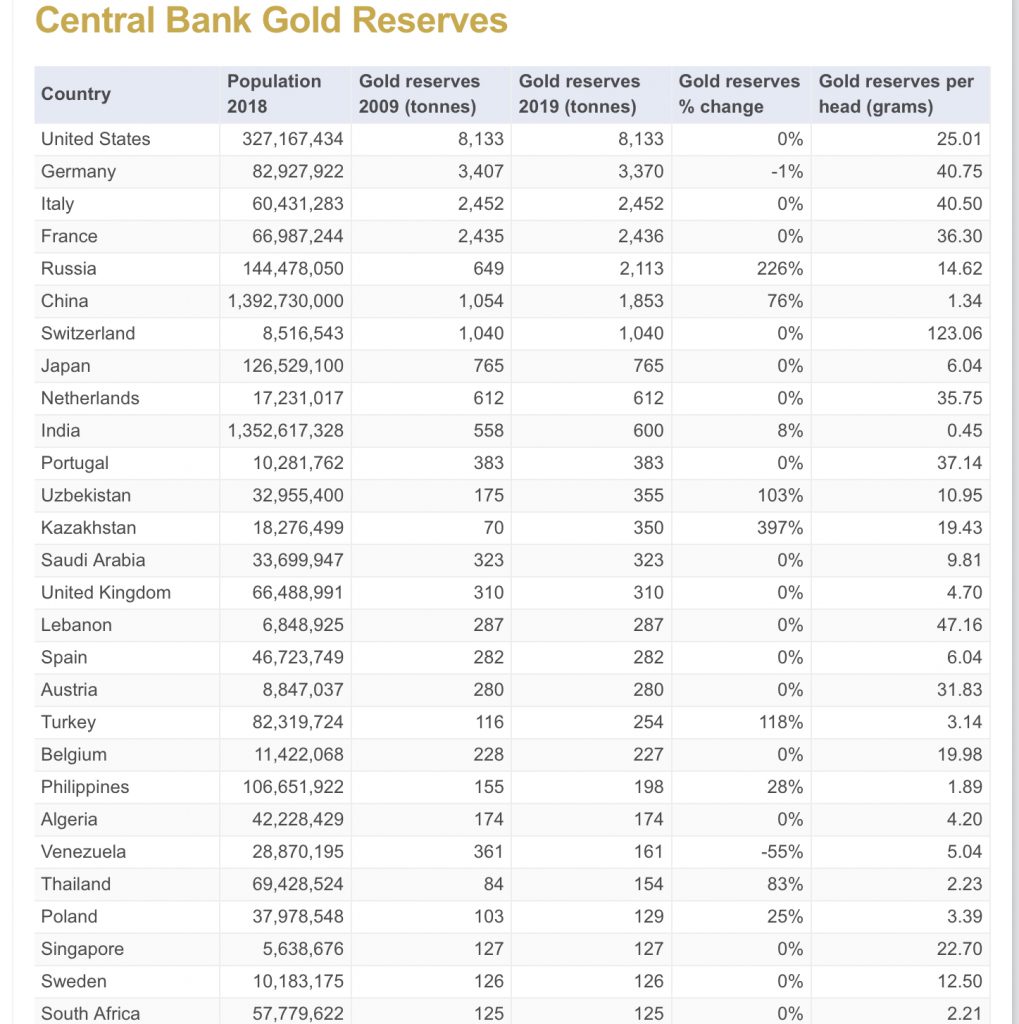

Since 2018, central banks around the globe have bought more gold than at any time in the previous 50 or so years.

Central banks in China, Russia, India, Turkey, Hong Kong, Egypt, Indonesia, Mongolia, Kazakhstan, and others, have been on a gold-buying spree.

If the world’s Central banks and elite are buying up as much gold as possible right now, does this mean that these insiders know something about upcoming financial changes that we don’t?

Many of the major countries and central banks across the world have gold in reserve as a Tier 1 asset.

Gold is real money.

“Money is Gold, and nothing else”, is a famous quote by influential banker J.P. Morgan back in 1912, but is very much relevant today. You may have heard a more common quote “Gold is money, everything else is credit”, which is a misquote but is most likely an updated version for modern times. Read more here.

As people will eventually demand that money is backed by something tangible, gold could once again play an important role in any monetary re-negotiations.

BullionVault. It’s free to open an account with Bullion Vault and registration takes less than a minute. There’s no obligation to trade.

4 Grams of FREE Silver on Sign up! VISIT BullionVault