If you’re thinking about buying and investing in the precious metal gold, you might want to know if 2022 is a good time to buy gold or not.

You’re in luck, because we’re going to explain whether 2022 is in fact a good time or not, together with other things to consider in the wider economy.

This year gold prices are likely to be heavily influenced by monetary policy in America as well as interest rates, and the worlds response towards a pandemic that has arguable changed the way we live forever!

Monetary policy will be a key issue 2022 because of interest rates being next to zero and printing money has never been higher than it is now.

An unprecedented economic response has caused many people to lose faith not only on stocks, but also currency markets around world.

Table of Contents

But what does this mean for gold in 2022?

It’s possible that all the stimulus measures taken by world governments is actually increasing instability.

This is because negative interest rates are hurting savers and also contributing to economic problems in countries where they have been introduced.

Geopolitical tensions have been a major worry for markets in recent years.

Trade wars and sanctions stifle economic growth, while the potential for conflict can also see gold prices rise quickly as investors seek safety amongst uncertainty abroad or at home, with their savings accounts getting steadily depleted by expensive living costs without any help coming from government programs which many people depend on these days.

For example, soaring energy prices have become a serious issue for many households especially in the UK with bills rising by more than 50% in the coming months.

The chief executive of British Gas recently said in an interview with the BBC that there was, “no reason” to expect that gas prices would come down “any time soon”.

He also warned that high energy bills would last at least two years.

However, you have to ask yourself, are they really likely bring prices back down after two years?

With economic uncertainties around the world, or inflation set to surge higher, it will be difficult to predict gold prices in 2022.

However, with that being said any investment is better than no investment and gold is one of the safest investments you can make at this present time.

Risk tolerance

When considering the risks associated with an investment, gold may be a good option.

The price of this valuable metal can fluctuate, and knowing when it’s at its lowest point is essential for those looking to maximize their potential return on investments.

For example, if you want quick profits then buying during times like these will help ensure that your profit margin isn’t eaten away by increased costs or decreased demand from investors.

But, because there are numerous aspects involved in predicting future market trends, such as economic conditions across countries around world, those who wish invest wisely should always do research first before deciding what time would suit them best.

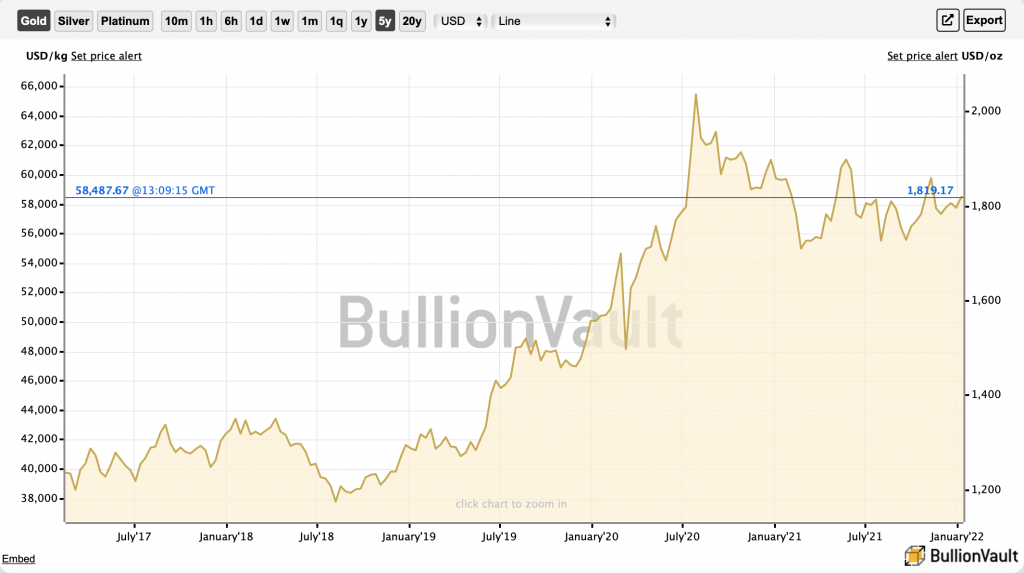

Currently gold is hovering around the $1800 mark (Jan 2022) which is still off its all-time high of just over $2060 back in August 2020, so there is potentially more room to the upside as these monetary policies are becoming more and more extreme.

Market volatility

One way to maximize your potential return on investment is to buy gold during times of market volatility.

As such, choosing this time to invest will provide you with the best opportunity to significantly increase your gains.

Additionally, you will also need to consider the fluctuations in the price of gold throughout a year.

It’s normal for this precious metal to experience highs and lows between January and April as well as September and December each calendar year.

Given this, buying during times when its value is at its lowest could be the best time for you to invest in gold bullion.

However, you need to always ensure that the timing is right for your investment goals.

For instance, if you intend to use gold as a form of protection against an impending recession or stock market crash, then gold is a great hedge.

Purchasing gold as a safe refuge during difficult times

Arguably there is a-lot of uncertainty for investors, so is 2022 the best time to buy gold?

With investment markets still recovering from the effects of Brexit and inflation running hot, debate is high over how soon or even if interest rates could rise.

With a whole host of unknowns being taken into account, it’s no wonder that some people are turning to gold.

Gold is often used for safe-haven investments in times of economic uncertainty.

In fact, many investors choose to invest in gold as a way of protecting themselves from the effects of a recession or a stock market crash.

Gold is a great hedge against the volatility and unpredictability found in investment markets.

Additionally, it’s worth remembering that financial institutions have been extremely cautious with regards to lending money to businesses and individuals since the credit crunch in 2008.

As a direct result, many businesses have found themselves unable to secure funding that would allow them to open up new branches, or even purchase much-needed equipment for their company.

The ongoing government restrictions has also made it difficult for many businesses, especially in the tourism and hospitality industry to turn a profit.

Gold could be seen as a more reliable investment as it does not rely on a company or its profits.

Investing in gold over a longer period of time

Gold can be great for both building personal wealth and hedging financial instability.

The past few years have seen gold prices steadily increase.

An upcoming event is expected to boost prices in 2022.

Chinese New Year in 2022 could spark another bull run, which could see the price of gold increase during this time.

Traditionally, families give each other red envelopes containing money – giving rise to the term ‘Lucky Money’ – while good luck and fortune is bestowed upon those who receive these envelopes.

Many investors in Asia follow Chinese traditions and it’s expected that this year’s celebrations will see a surge in demand for gold due to these cultural factors. This is expected to give prices a much-needed boost, which could be just the thing to help you turn a profit when investing in gold.

What’s the point in investing in gold in 2022?

We’ve all heard that as an investor, “gold pays no interest.” So, what’s the point in investing in gold in 2022? It doesn’t gain value like stocks. It doesn’t provide income like bonds. It doesn’t come with dividend payments like blue-chip stocks. So, what is it good for?

Well, the price of gold has an inverse correlation to paper currencies – as one goes up in value, the other goes down. In times of economic uncertainty, this is a great time to invest in gold because you can still sell it with a high return years from now.

The price of gold is set to remain high in 2022 because many central banks have been buying more bullion as a hedge against economic instability. This should keep demand for gold stable and support the market, which could lead us towards an even smoother rise over time!

Gold is likely to remain a safe haven and inflation hedge in 2022

Gold has been a safe haven and inflation hedge for centuries. Gold price predictions are likely to fluctuate significantly in 2022, reflecting the upheaval caused over 18 months ago by restrictions which wreaked havoc on economies worldwide.

But this won’t stop people looking outwards towards gold as one way they can protect themselves against future emergencies or crisis situations.

So is 2022 the best time to buy gold?

It’s fair to say that there are plenty of factors supporting its value in 2022 and beyond.

Investing smartly and in-depth research will help you determine what is best for you and whether 2022 is the best time to buy gold?

This article is not an investment advice. Any references to historical price movements or levels is informational and based on external analysis, and we do not guarantee that any such movements or levels are likely to reoccur in the future.

Main image by Zlaťáky on Pixabay