There is something truly special about holding physical gold or silver bullion in your own hands. With literally thousands of years of history, people who buy gold and silver often see these precious metals as the ultimate store of value, preserving wealth for generations.

Table of Contents

Why do people buy gold and silver bullion?

For centuries, gold and silver have naturally become the predominant precious metals of choice for sound money.

Sound money is money that is not liable to sudden appreciation or depreciation in value.

Throughout history Fiat Currencies have come and gone, but gold and silver have always maintained purchasing power.

This is why gold and silver can be seen as real money as both gold and silver will always have value.

These day’s, physical gold and physical silver often come in the form of investment bars and investment coins.

Savers and investors alike regard these particular precious metals as great stores of value, as well as being safe-haven assets in times of financial crises.

Do people use gold and silver to diversify an investment portfolio?

Investing in precious metals is also seen as a way of diversifying investment portfolios by protecting against potential stock market crashes, currency debasement, inflation, political instability and systemic risks within the financial system.

Gold and silver usually move in different ways to the prices of assets such as stocks and bonds.

Diversifying your investments to include physical gold and silver can reduce the overall risk of your investment portfolio.

Protection against inflation.

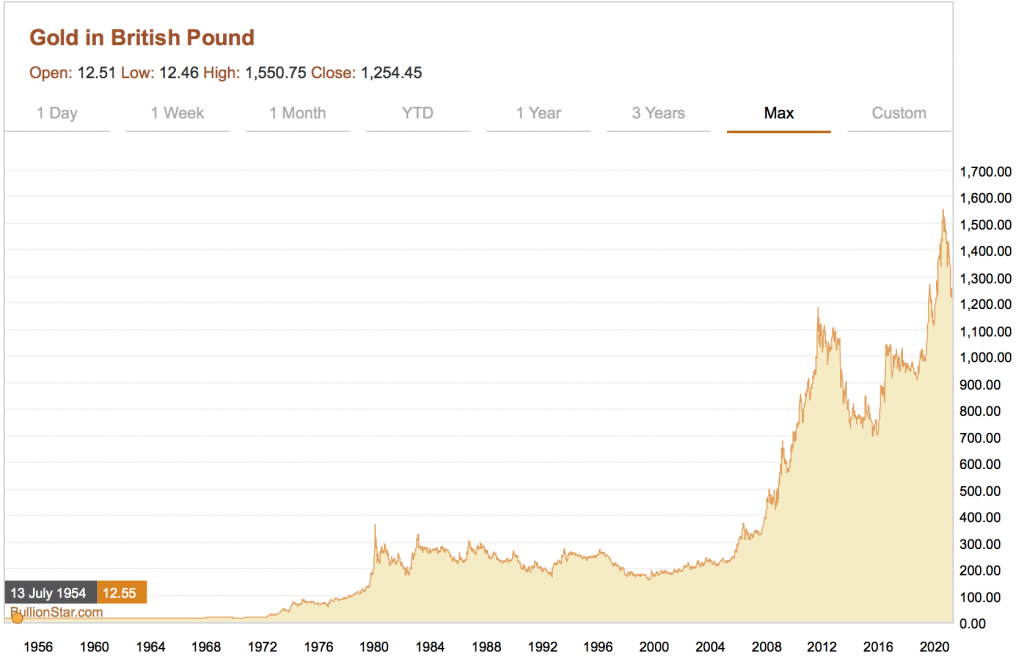

It is proven that over long periods of time gold and silver retain their purchasing power and protect against inflation, which is the increase in the general price levels of goods and services.

Counterparty risk.

In times of financial crises, gold and silver are also seen as safe-haven assets, because both gold and silver have no counterparty risk.

Counterparty risk, is the risk of one or more parties in a financial transaction defaulting on or otherwise failing to meet their obligations on that trade.

Counterparty risk is with us in everyday life, when investing or making transactions. It is the probability that the other party in a trade, investment or credit transaction might default on the contractual obligation, therefore not fulfilling its part of the deal. Read more about counterparty risk here.

Gold and Silver are scarce assets.

Both gold and silver are difficult and costly to mine, they are scarce, which prevents the market from being flooded with physical precious metal. Limited quantities ensure a scarcity value.

Unique properties.

Gold and silver have unique metallic characteristics which means they are always in demanded for various industrial, jewellery and investment purposes.

They are durable and stable, with a low melting point making it easy to be fabricated into bars or coins.

Silver in particular is the most conductive of all metals, it is extremely malleable, it is the most reflective of all metals, it has anti-bacterial qualities, the list goes on.

Silver is used in solar panels, electric cars, batteries, glass coatings, water purification, touch screens, LED lighting etc.

Read more about silver here.

Long history as money.

Gold and silver have been used as money from as far back as 600 B.C.

Gold and silver were used as the backing or foundations of many countries’ money supplies. Gold was the anchor of the global monetary system between 1944 and 1971.

In 1971 president Nixon ended the Breton woods system, which essentially ended the last link to gold.

The dollar is now a debt backed standard. As all major currencies across the globe were pegged to the dollar, then essentially all currencies became fully fiat currencies backed by nothing but debt.

At this point the dollar was no longer backed by gold at all.

Gold has always been the consistent form of money throughout history for literally thousands of years. An ounce of gold is still an ounce of gold and it still has high value today, while fiat currencies such as the dollar and the pound consistently loose value over time.

Read more about the history of gold as money here.

Fiat or paper currencies have no intrinsic value.

Fiat currencies such as the US dollar, Euro and the pound sterling are subject to dilution of supply via currency debasement as well as being subject to political interference.

Central banks such as the Bank of England and others, are continuing to create huge amounts of quantitative easing programmes (printing money), which is essentially devaluing fiat currency, including the pound sterling.

This process of quantitative easing continues the erode the purchasing power of fiat currencies.

Since 1913, the U.S. dollar has lost around 98% of its purchasing power.

Gold and silver are not subject to political interference or dilution to their supplies.

Central banks actually hold vast amounts of gold bullion as reserve assets as gold is a Tier 1 asset. Central banks know that gold is the ultimate store of value which is not eroded over time by inflation.

Gold also provides central banks with an insurance policy of emergency funding in the result of a financial market or fiat currency meltdown.

Central banks hold real gold and not paper claims.

Gold and silver bullion is always in demand while supply is limited.

Both gold and silver are in demand all over the world, every country on the planet knows that these precious metals have value.

Not only do they have demand for bars and coins for retail investment, demand also comes from Exchange Traded Funds (ETFs). The global precious metal jewellery sector, central bank gold demand, industry, the list goes on.

Gold and silver supply comes from mine production, precious metals recycling and existing above ground stocks. Supplies of these metals only grow slowly over time.

Ultimate store of value.

People buy gold and silver as a reliable store of value.

One ounce of gold will buy you roughly the same amount of goods and services that it did in the past despite the prices of those goods and services increasing.

This is why gold is often seen as the ultimate form of wealth preservation. Both gold and silver are not a ‘get rich quick scheme’, they protect your purchasing power over time.

Compare this to fiat currencies which continually lose value over time due to inflation.

Fiat currencies are also susceptible to hyperinflation where the currency simply becomes worthless. Venezuela, Hungary, Zimbabwe, and Yugoslavia have all experienced periods of hyperinflation.

Every fiat currency in history has eventually gone back to the intrinsic value of zero.

Simply put, fiat paper currencies are not a good store of value.

Trust.

Often investors move money into gold and silver during a crisis in the markets.

Why do they choose gold and silver? Because these physical precious metals do not have any counterparty or default risks.

Physical gold and silver do not depend on another party for their worth.

Bonds depend on a borrower to pay the interest; property depends on tenants; stocks depend on companies to generate profits.

Gold and silver do not rely on anything. They have intrinsic value that you can trust.

These metals are a highly liquid investment and have recognition worldwide so you can liquidate your assets at any time easily.

When people buy gold and silver, they trust the intrinsic value of the precious metal.

Conclusion.

Owning gold bars, silver bars, gold coins and silver coins is a great way to protect your savings in the form of real money outside of the financial system.

This can protect you from the very real risks of political crises, financial market panic, currency debasement and more, as well as being a reliable store of value, protecting your purchasing power and giving you peace of mind that both gold and silver will never go to zero.

You can pass on your wealth through gold and silver bullion for generations to come.