Why did 90% of UK pension funds almost collapse?

Recently an extraordinary thing happened, it is estimated that 90% of all UK pension funds almost collapsed, but why?

It all started when there was a huge sell off in Government bonds, which are also known as ‘gilts’, just after the governments mini budget policy announcements which took place on the 23rd September.

The policies included an extremely large amount of unfunded tax cuts as well as vast government borrowing programs, this also triggered a plunge in the value of the pound to an all time low against the dollar.

Some of the bonds held within these UK pension funds lost around half their value in a matter of days.

This almost immediate dive in bond values caused widespread market chaos, in-particular in the LDIs (liability-driven investment funds), with an estimated value of around £1.5trillion!

This dive meant pension funds started to receive margin calls from brokers demanding that these pensions increase equity/funding amount when the value of the bonds falls below the amount required.

The vast majority of these LDIs (liability-driven investment funds) are owned by workplace pensions & final salary pensions which have promised its clients (anyone with a workplace/final salary pension) an income for life often based on final salary.

The pension funds with these so called LDIs had to essentially sell off very large portions of their long term gilt (bond) positions as the value fell off a cliff. There were widespread warnings that multiple LDI funds were likely to fall into negative asset value.

A very large quantity of gilts are held as collateral by banks that had essentially lent to these LDI funds. Without Bank of England intervention these banks holding bonds would likely have sold on the market, driving a potentially self-reinforcing spiral.

UK pension funds were ‘hours’ away from collapse.

In a recent interview with Channel 4 news The Governor of the Bank of England Andrew Bailey said that the recent volatility in the bond market was:

“becoming unstable and it was affecting … pension funds for instance, and how they were operating.”

He went on to add:

“We certainly reached a point where markets were very unstable, and these were core markets, this is the Government bond market, which is in many ways the most core of all.”

When asked if the UK bond market was days or hours away from a total meltdown, he replied: “I think at that point when we intervened, I can tell you that the messages we were getting from the markets were that it was hours.”

He continued:

“Our worry was that when you get into that situation, this can easily spread very rapidly and then you have a huge job on your hands to get it back under control. We had to step in quickly and we had to step in quite decisively.”

The Bank of England then begin ‘temporarily’ buying long-dated bonds in order to try and calm the markets which has tamed the situation for now, however, there are already jitters from market analysts and traders predicting that another bond market meltdown could be building as the BOE has simply kicked the can down the road as the core problems of huge government debt, spiralling interest payments and looming recession have not gone away.

Could gold be an alternative to protect your pension plan?

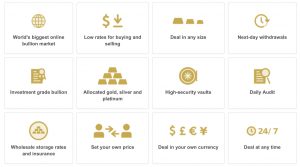

Gold could be an ideal alternative to all this bond market volatility and over leveraged funds as gold can be held outside the standard pension system.

You could add gold to your retirement portfolio as a way to hedge against pension fund collapse or indeed bond market collapse.

Gold and Silver UK has often talked about the possibility of large key markets such as the bond market, which is in the trillions, potentially collapsing due to various economic factors and governments simply getting fiscal policies constantly wrong.

This has now played out, and the Bank of England has simply put a sticking plaster on the problem. The UK is facing huge economic volatility right now and it could be seen as prudent to mitigate at least some of this risk in the safety of Gold.

Gold has retained its value through this uncertain economic time and is tried and tested as the ultimate safe haven asset when it comes to safely storing and investing your wealth for years to come.

Gold bullion is viewed by many investors as a good way of hedging against risk especially when the risk seems very high in this current economic climate.